This article provides an update (as of 10:00 UTC on August 29) on the cryptoasset market, with a particular focus on the following digital assets: Bitcoin (BTC) , Ether (ETH), Litecoin (LTC), VeChain (VET), UMA, and Synthetix (SNX).

To give you a rough idea of how well the crypto market is doing today, 12 of the top 20 cryptoassets (by market cap) are currently in the green (i.e. up against USD).

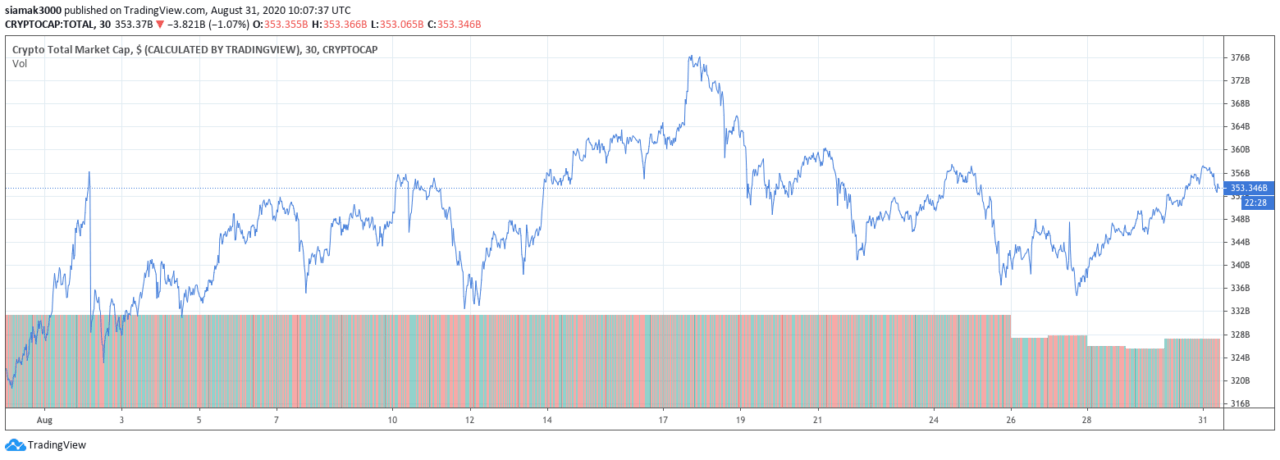

According to data from TradingView, during the past 24-hour period, the total crypto market cap has decreased by $315.98 million (or 0.09%), and as of 10:00 UTC on August 31, it stands at $353.12 billion. Below is a chart form TradingView that shows how the total market cap has changed over the past month:

The Crypto Fear & Greed Index, which is based on an analysis of “emotions and sentiments from different sources”, is currently telling us that we are in “Greed” category:

All market data used in the remainder of this article was taken from CryptoCompare around 10:20 UTC on 31 August 2020.

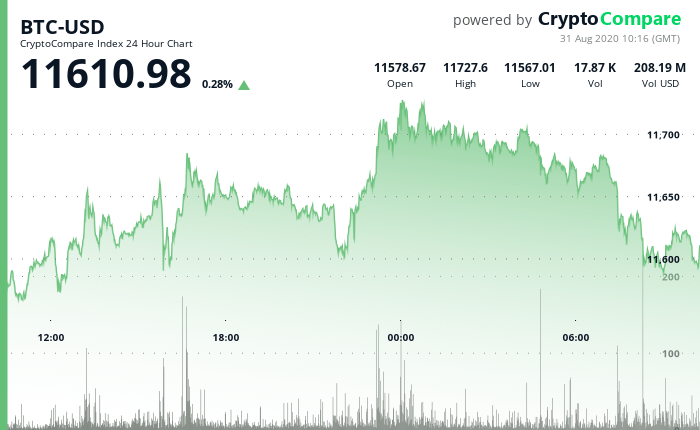

Bitcoin (BTC)

Bitcoin is currently trading around $11,610, up 0.28% vs USD in the past 24-hour period:

In the year-to-date (YTD) period, Bitcoin is up 61.63% vs USD. BTC dominance stands at 55.6%.

According to data from Blockchain.com, Bitcoin’s seven-day average hash rate reached 125.52 EH/sec on Sunday (August 30); the average total hash rate reached its all-time high (ATH) of 128.705 EH/sec on August 17.

Since Fed Chair Jerome Powell’s historic speech on August 27, Bitcoin has mostly been trading around the $11,500 level. Powell said that the Fed would not mind if inflation went a little above its usual 2% target as long as average inflation stayed around 2%.

Although many people in the crypto space like to see the Fed’s new stance on inflation as highly bullish for Bitcoin, due to the economic impact of the current COVID-19 pandemic, it is by no means certain that we will have high inflation anytime soon, and so currently it seems that the only thing that could might Bitcoin above the $12K level is the bull market being experienced by certain altcoins, which is primarily those associated with decentralized oracle platforms and decentralized finance (DeFi) platforms.

Synthetix founder Kain Warwick says that, although he is a BTC holder, he is worried that Bitcoin may not enjoy a major rally since you do not need bitcoin to get into DeFi token speculation:

However, in the long term, most people in the crypto space seem to feel that Bitcoin’s store of value narrative should help its price to appreciate significantly in the years ahead.

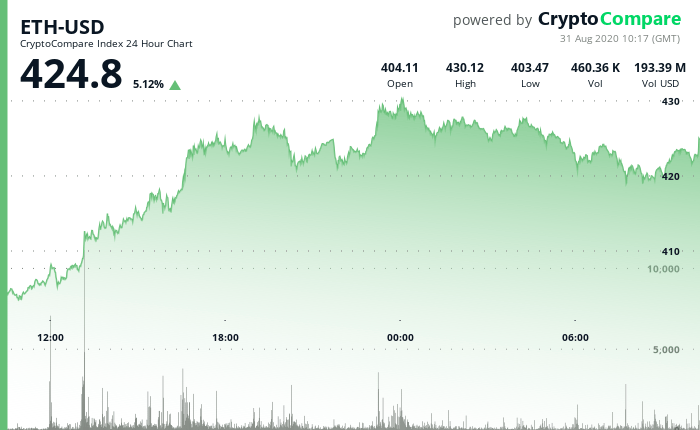

Ether (ETH)

Ether is currently trading around $424.80, up 5.12% vs USD in the past 24-hour period:

In the YTD period, Ether is up 229.53% vs USD.

The two main tailwinds for Ethereum are (i) the red hot DeFi sector, which is mostly powered by Ethereum, which (among other things) means that you need ETH to pay transaction feeds when trading DeFi (which a lot of people are doing on decentralized exchanges such as Uniswap); and (2) the upcoming launch of ETH 2.0, which will offer staking (i.e. a way to earn passive income from your ETH holdings).

On Saturday (August 30), Ethereum co-founder Vitalik Buterin tweeted about TxStreet, a blockchain transaction visualizer that currently supports both Bitcoin, Bitcoin Cash, and Ethereum:

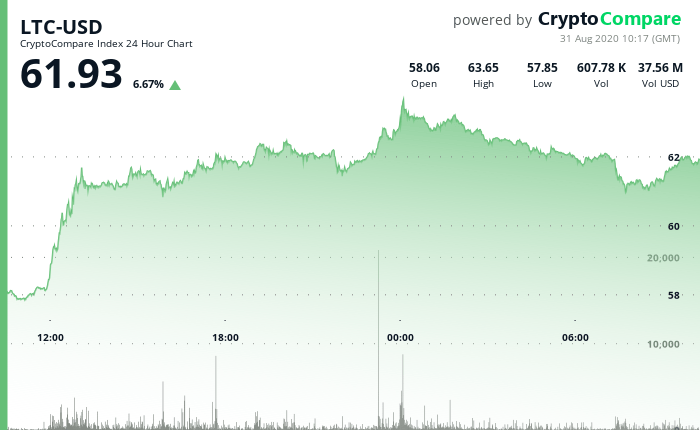

Litecoin (LTC)

Litecoin is currently trading around $61.93, up 6.67% vs USD in the past 24-hour period:

In the YTD period, Litecoin is up 50.31% vs USD.

On Saturday, Litecoin Foundation said on Saturday (August 29) that the .999 fine silver cards it had commissioned Ballet Global, Inc. to make—which was first announced on August 11—were now ready to be shipped out:

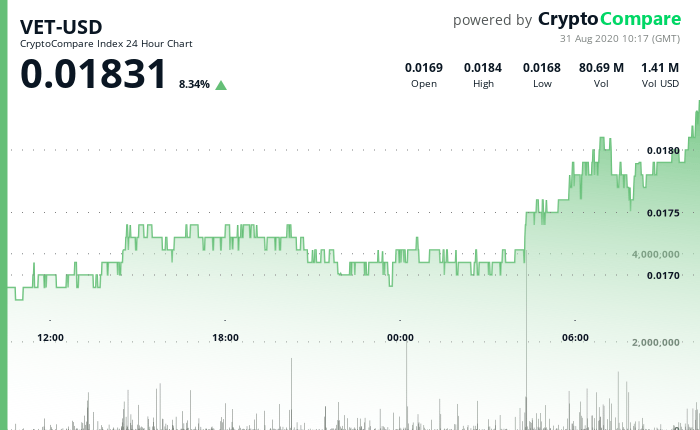

VeChain (VET)

The VET token is currently trading around $0.01831, up 8.34% vs USD in the past 24-hour period:

In the YTD period, the VET token is up 251.03% vs USD.

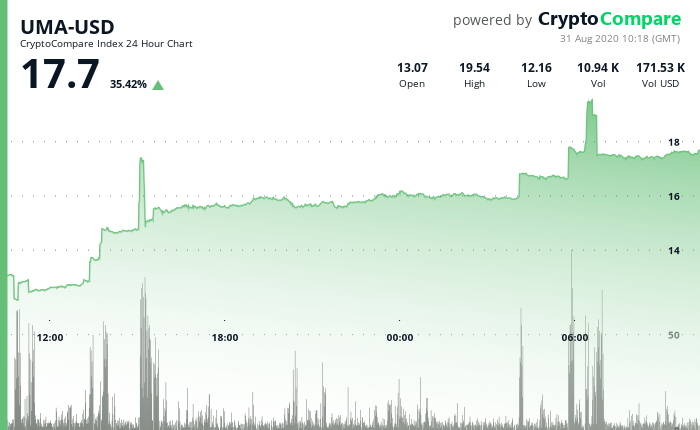

UMA

UMA is the governance token of UMA, which is “a protocol for building synthetic assets.”

The UMA token is currently trading around $17.70, up 35.42% vs USD in the past 24-hour period:

In the YTD period, the UMA token is up over 5741% vs USD.

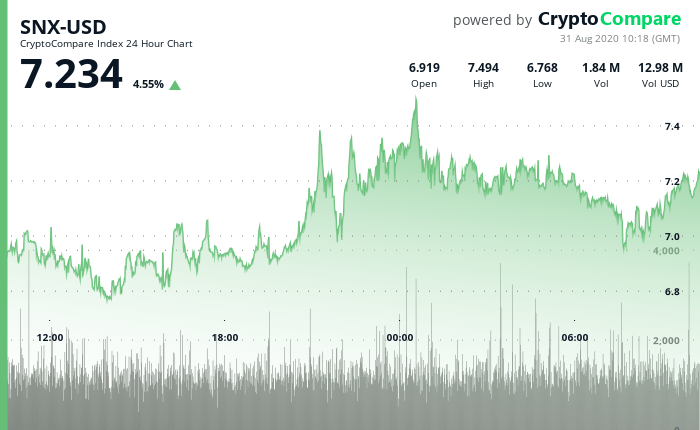

Synthetix (SNX)

The SNX token is currently trading around $7.234, up 4.55% vs USD in the past 24-hour period:

In the YTD period, the SNX token is up over 1733% vs USD.

On Friday (August 28), Synthetix that SNX perpetual contracts had gone live on MCDEX:

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.