This article provides an update on the cryptoasset market, with a particular focus on the following digital assets: Ether (ETH), Chainlink (LINK), Litecoin (LTC), yearn.finance (YFI), and Terra (LUNA).

To give you a rough idea of how well the crypto market is doing today, all of the top 30 cryptoassets (by market cap) are currently in the red (i.e. down against USD). All market data used in this article was taken from CryptoCompare around 09:30 UTC on 19 August 2020.

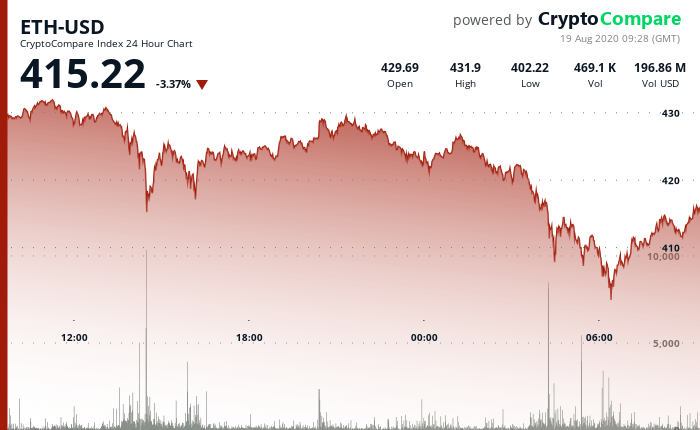

Ether (ETH)

Although the Ether price to as low as $402.77 at 06:25 UTC, Ether is currently trading around $415.22, down 3.73% in the past 24-hour period. Ether’s return on investment (ROI) for the year-to-date (YTD) period is +222.10% vs USD.

On Tuesday (August 18), Raul Jordan, Co-Founder at Prysmatic Labs, published a blog post in which he explained that last weekend ETH 2.0 public testnet Medalla “spiraled into a series of cascading failures” that “exposed several vulnerabilities and process faults in how to best handle critical scenarios.”

Here is a summary from Jordan of what went wrong:

“Starting with the receipt of bad responses from 6 different time servers which threw off most nodes running our Prysm client at the same time, our team rushed to push a fix to the problem.

“This fix contained a critical flaw which removed all necessary features for our nodes to function.

“This problem led to network partitions, with everyone synchronizing the chain at the same time but unable to find a healthy peer, Medalla had a very eventful weekend and offered us the greatest learning experience to prevent this happening again, especially on mainnet.”

And here are the lessons that Prysmatic Labs learnt from this experience:

- “Don’t rush to merge in fixes”

- “Careful external communication regarding updating nodes in periods of instability is critical”

- “Make migrations to other eth2 clients seamless and well-documented for users”

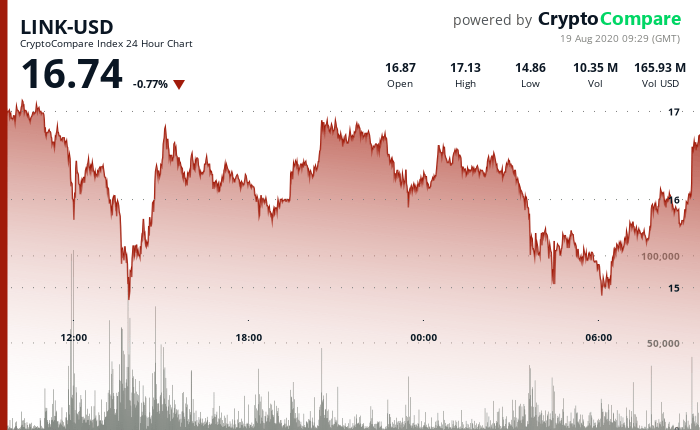

Chainlink (LINK)

Chainlink’s native token is currently trading around $16.74, down 0.77% in the past 24-hour period.

This means that LINK has fallen 7% since Dave Portnoy, the founder and president of Barstool Sports, bought $50,000 worth of LINK tokens on Thursday (August 13) with the help of the Winklevoss twins. The good news is that LINK is still up 851.13% vs USD so far in 2020.

On Tuesday (August 18), Chainlink announced two new partnerships:

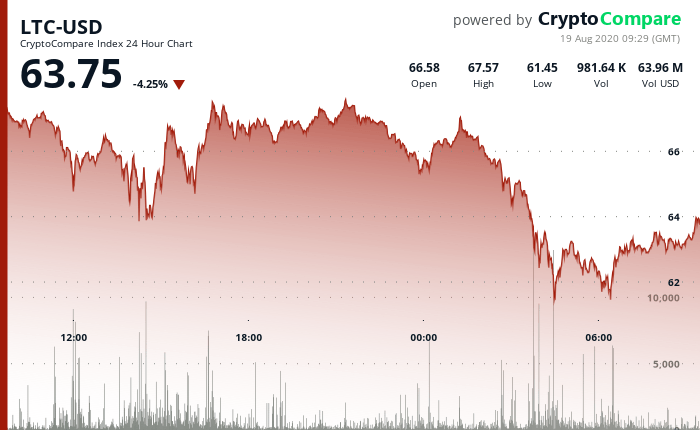

Litecoin (LTC)

Litecoin is currently trading around $63.75, down 4.25% in the past 24-hour period; it’s ROI vs USD for the YTD period is +54.73%.

Earlier today, Litecoin creator Charlie Lee provided this nice summary of recent Litecoin-related news:

The second item on his list is “Grayscale Litecoin Trust (LTCN).”

On Monday (August 17), crypto investment firm Grayscale Investments, LLC (“Grayscale”), which is a wholly-owned subsidiary of Digital Currency Group, Inc. (“DCG”), announced that Grayscale® Bitcoin Cash Trust shares and Grayscale® Litecoin Trust shares had become publicly-quoted securities in the U.S. (trading under the symbols BCHG and LTCN respectively).

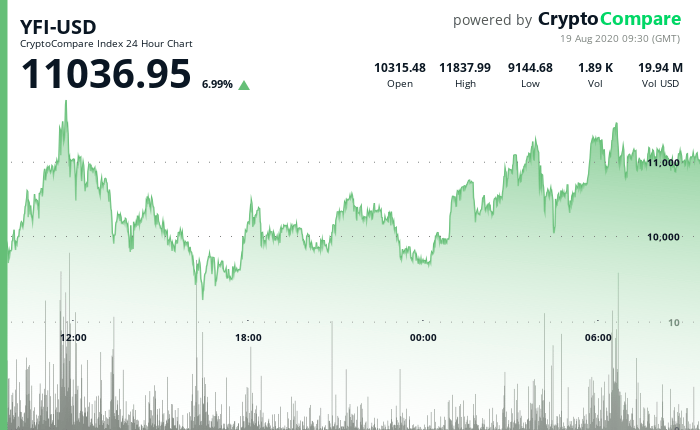

Yearn.Finance (YFI)

YFI is currently trading around $11,036, up 6.99% in the past 24-hour period.

As crypto analyst/investor Andrew Kang pointed out on Tuesday (August 18), just over a month ago, YFI was priced around $3:

This means that YFI’s ROI vs USD for the YTD period is a crazy +367766%.

On July 24, Kang sent out the following tweet to summarize the main differences between BTC and YFI:

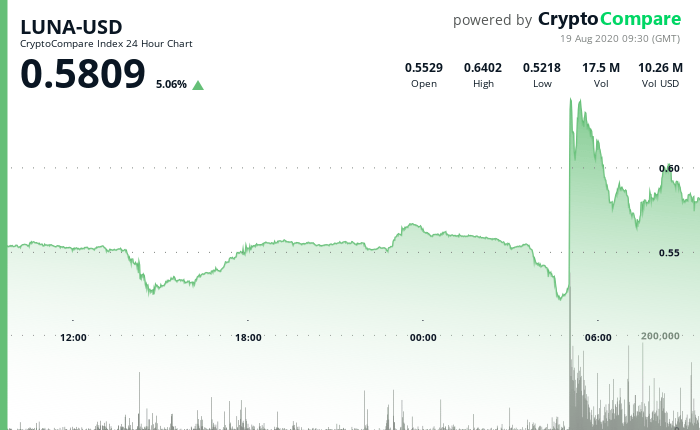

Terra (LUNA)

LUNA is currently trading around $0.5809, up 5.06% in the past 24-hour period; it’s ROI vs USD for the YTD period is +101.55%.

Earlier today, Binance announced that it would list LUNA and open trading for LUNA/BTC, LUNA/BNB and LUNA/BUSD trading pairs at 10:00 UTC.

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.