Although Bitcoin’s rolling 30-day correlation with gold is not currently as high it was last Friday (August 7), when it reached the all-time high of 68.9%, its price seemingly continues to move in lockstep with the price of gold.

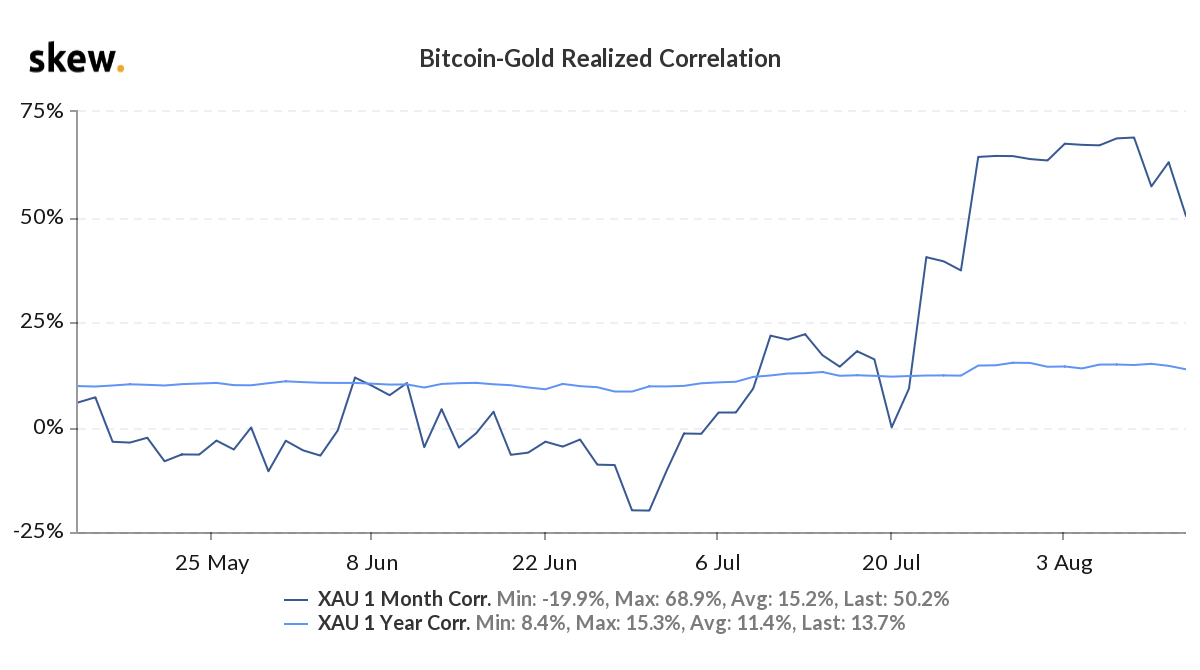

Below is a chart from Skew that shows how the rolling 30-day correlation between the price of Bitcoin and gold has changed over the past three months:

Below are some of the highlights during this period:

- 30 June 2020: 1-month correlation reaches -19.9%.

- 1 July 2020 to 9 July 2020: 1-month correlation continued to increase until it reached +21.8%.

- 10 July to 20 July 2020: 1-month correlation kept decreasing until it reached -0.1%.

- 21 July to 7 August 2020: 1-month correlation went from +9.2% to an all-time high of +68.9%.

- 12 August 2020: 1-month correlation was +50.2%.

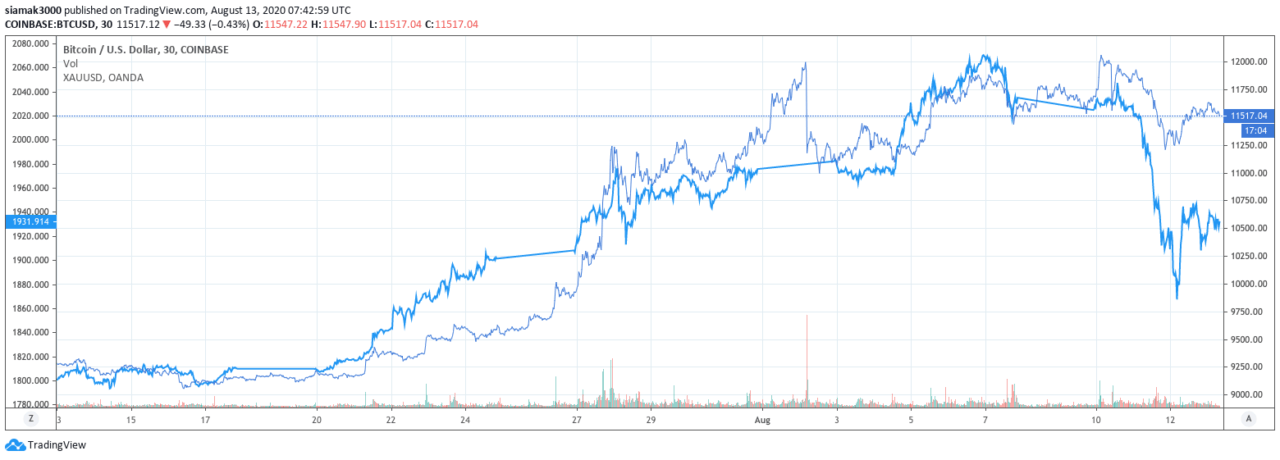

And here is a chart from TradingView that shows how the prices of Bitcoin in USD (BTCUSD) on Coinbase and spot gold in USD (XAUUSD) on Oanda have changed over the past one-month period:

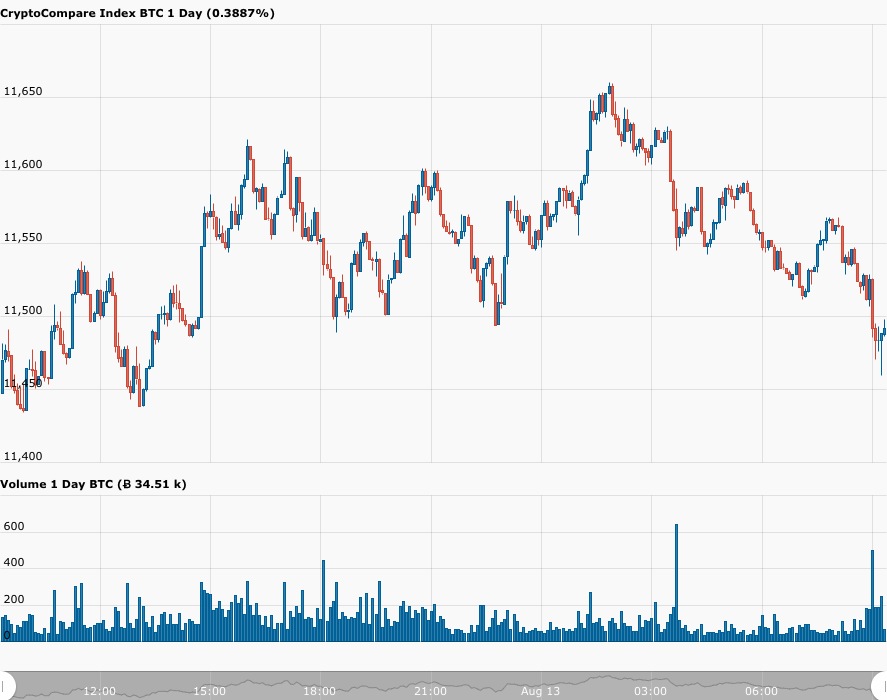

At the time of writing (08:25 UTC on August 13), according to data from CryptoCompare, Bitcoin is trading around $11,490, up 0.47% in the past 24-period.

During this period, Bitcoin has been trading between $11,468 and $11,660.

Meanwhile, according to GoldPrice.org, spot gold is currently (as of 08:25 UTC on August 13) trading around $1,928 an ounce, up 0.40% today.

On Monday (August 10), crypto exchange Kraken announced via a blog post that its research division—Kraken Intelligence—had released its Bitcoin Volatility Report for July 2020.

With regard to the correlation between the prices of gold and Bitcoin, here was one of the key takeaways from Kraken’s report:

Concerns over the state of the global economy and a shift towards safe haven assets resulted in Bitcoin’s rolling 30-day correlation with gold flipping from a 10-month low of -0.66 on July 2 to a 1-year high of 0.93 on July 31.

Kraken Intelligence also mentioned that historically, August has been the third most volatile month (with a “9-year average annualized volatility of 88%), and that in the months ahead, Bitcoin’s volatility could exceed 100%, which means that we could see Bitcoin rally “somewhere between +50% and +200%”.

On Tuesday (August 11), Kitco News published an interview with VanEck Gold Portfolio Manager and Strategist Joe Foster, who has a long-term price target of $3,400 an ounce for gold.

If the macro drivers for gold (such as negative real interest rates, geopolitical and financial risks around the world, and the huge amount of sovereign and corporate debt) remain forseeable future and Bitcoin’s recent moderately high correlation with gold continues, it could mean that the rallies for both of these safe haven assets are far from over.

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.