MakerDAO, the non-custodial lending protocol used to create DAI stablecoins, has become the first in the decentralized finance (DeFi) space to surpass $1 billion in total value locked in it.

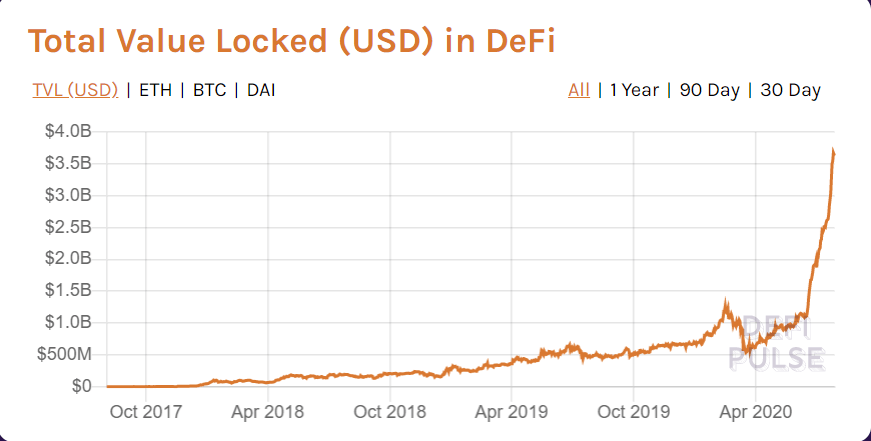

The milestone comes as users keep on locking cryptoassets in the DeFi space, so much so it has grown from over $660 million in total value locked at the beginning of the year, to now have over $3.6 billion locked in the space. The $1 billion milestone for the entire space was reached in February, before exploits saw the value drop to $560 million.

It was then once again breached in early June, and now nearly two months later MakerDAO has surpassed $1 billion in total value locked on its protocol. Its dominance of the DeFi space is of only 27.7%, as other projects follow closely behind.

Compound, a lending protocol where users can deposit token to earn interest or take out loans, has $788 million locked in it, while Synthetix has $437 million. Aave, Balancer, and Curve Finance are also in the top 10.

As CryptoGlobe reported, the DeFi-related craze has been such that activity on the Ethereum network reached a two-year high in late June thanks to it, as investors were increasingly interacting with protocols in the space. The popularity of the space has seen Waves CEO Sasha Ivanov warn against the surge in interest, as it could lead to another ICO bubble. Ivanov said:

DeFi is the future, but it’s going to be coming through a bubble part of the cycle now, which can harm its long-term development.

The trend has also seen the Ethereum network process over one million transactions per day. The activity on the network has been such that fees to transact on ETH are now superior to those paid to transact on the BTC network, on average. This, despite a gas limit increase this year.

Featured image via Pixabay.