Per data released yesterday (July 30) by the U.S. Bureau of Economic Analysis (BEA), in Q2, U.S. GDP dropped 32.9% on annualized basis. Meanwhile, Bitcoin continues to do well, seemingly slowly grinding toward the $11,500 level.

The BEA, which is an agency of the U.S. Department of Commerce, issued a press release titled “Gross Domestic Product, 2nd Quarter 2020 (Advance Estimate) and Annual Update” at 08:30 ET on Thursday (July 30).

Real gross domestic product (GDP) fell at an annual rate of 32.9% in the second quarter (compared to a decrease of 5.0% in Q1 2020).

The BEA blamed this huge drop in Q2 real GDP―which was the largest quarterly drop since 1947, which is when the U.S. government started keeping record of quarterly GDP―on the current COVID-19 pandemic:

“The decline in second quarter GDP reflected the response to COVID-19, as ‘stay-at-home’ orders issued in March and April were partially lifted in some areas of the country in May and June, and government pandemic assistance payments were distributed to households and businesses.

“This led to rapid shifts in activity, as businesses and schools continued remote work and consumers and businesses canceled, restricted, or redirected their spending.

“The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the second quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified.”

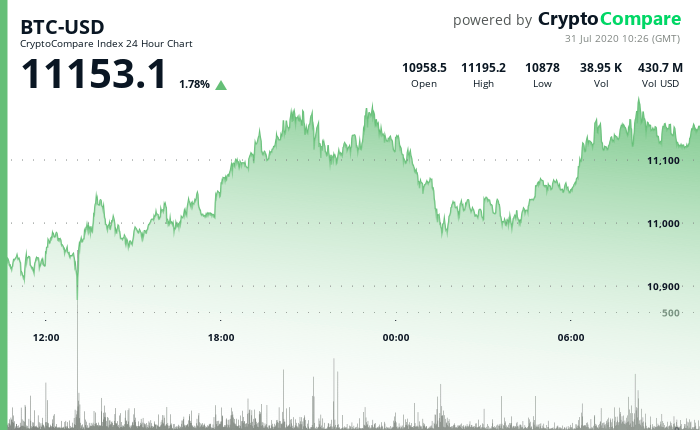

As for Bitcoin, according to data by CryptoCompare, currently (as of 10:26 UTC on July 31), Bitcoin is trading around $11,153, up 1.78% in the past 24-hour period:

On Tuesday (July 28), in an interview with CNBC’s “Squawk Box”, Michael Novogratz, a former Goldman Sachs partner, as well as Founder, Chairman, and CEO of crypto-focused merchant bank Galaxy Digital, said due to the global “liquidity pump”, he expected both gold and Bitcoin―which he has placed big bets on― to continue to do well going forward.

With regard to Bitcoin, he expects Bitcoin’s price to reach $14,000 within the next three months and $20,000 by the end of this year.

The latest analysis from on-chain market intelligence startup Glassnode shows that despite Bitcoin’s surge to $11,000 and beyond, long-term HODLers do not appear interested in cashing out at these levels:

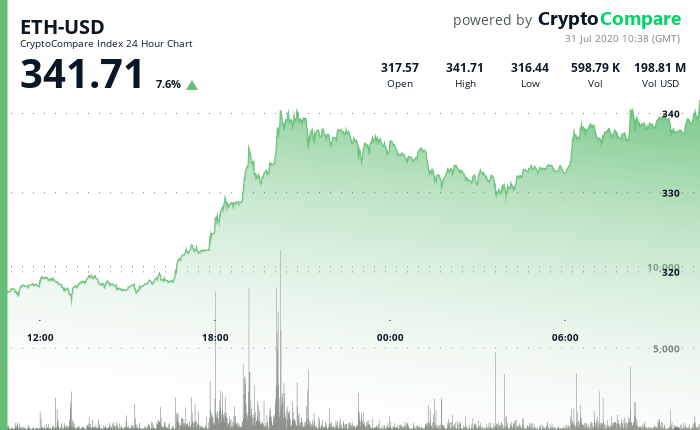

As for Ethereum, which celebrated the fifth anniversary of its mainnet going live, Ether (ETH) continues to impress in 2020, going up 7.6% in the past 24-hour period to reach $341.71, which means that in the year-to-date (YTD) period, Ether is up 164.65% against USD:

Popular crypto analyst/trader Josh Rager, who is also a Co-Founder of online crypto learning platform Blockroots, as well as an advisor to several blockchain startups, seems quite bullish on Ether based on his reading of the price charts:

Featured Image by “WorldSpectrum” via Pixabay.com