Recently, hedge fund manager and CNBC contributor Brian Kelly explained why he is so bullish on Bitcoin and in particular why he expects the price to reach $50,000 “sometime in Q2 2021.”

According to his bio on the CNBC website, Kelly is the founder and CEO of BKCM LLC, an asset management firm focused on “global macro and currency investing, including investing in digital currencies.” Furthermore, he is the portfolio manager of the BKCM Digital Asset Fund and the REX BKCM Blockchain ETF.

Kelly is also the author of the book “The Bitcoin Big Bang: How Alternative Currencies Are About to Change the World” (which was published by Wiley in November 2014).

On Monday (July 27), Melissa Lee, who is the host of CNBC show “Fast Money”, asked Kelly which asset he was most bullish on — gold, silver or Bitcoin.

Kelly replied:

“Well, for me, it’s going to be Bitcoin. You might say ‘well, BK, your are biased because you run a crypto fund’, but that’s not it.

“I also trade macro, which means I have a whole bunch of different things that I can invest in — currencies, stocks, bonds, precious metals — and when I look at precious metals versus Bitcoin, Bitcoin has better fundamentals, and with fundamentals, I’m talking about the stock to flow ratio.

“It’s better than gold at this point because we had the halvening, and when I look at the Bitcoin cycles, the bull markets tend to cluster around the halvenings, and so we’re tracking right along like the 2016 halvening cycle, and that would imply that sometime in Q2 2021 you’re looking at a Bitcoin price of 50,000.

“So, that’s kind of a long-term target and in the shorter term, $10,500 was a really big number.

“We’re breaking out of a two-year range… once you break out of the range, goes to prior highs — that’s $20,000. To me, that’s three to six months down the road.

“So Bitcoin looks like it go two to five times higher whereas is gold going to go to $4,000? Is it going to go to $10,000?”

Lee then challenged Kelly, asking him why people should believe such “sky high forecasts” now when similar predictions were made last year and they did not come true.

Kelly answered:

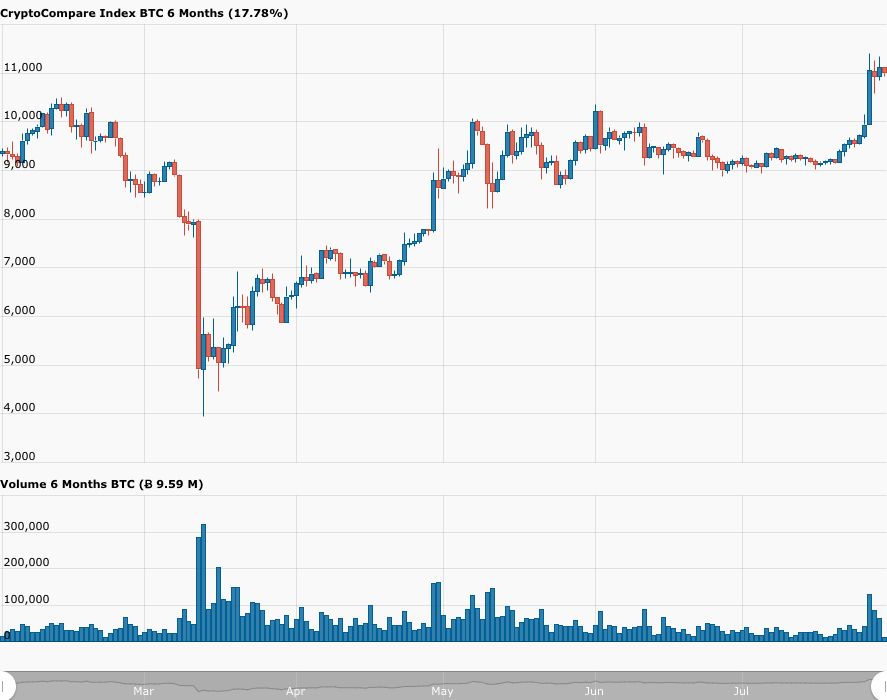

“People may be skeptical [but] let’s remember in March, Bitcoin was $3,500, so it’s already tripled all right?…

“A lot of [who] had one two thousand dollars in Bitcoin in 2017 didn’t think it could go to $20,000. What we know about Bitcoin is that it’s extremely volatile, it’s highly speculative, and when it goes on these speculative runs, it goes a lot further than people expect.

“So, you know, I don’t think saying $20,000 is that outrageous when it’s already been there.

“You might question me on the $50,000, but that’s a year from now.”

Since the “Black Thursday” crash back in March, Bitcoin has gone up 177.17% against USD:

Featured Image by “Maklay62” via Pixabay.com