On Wednesday (April 1), the team behind Huobi Wallet, the multi-cryptocurrency wallet from Huobi Group, announced that it plans to integrate into this wallet the services provided by crypto-backed lending and borrowing platform Cred.

Cred offers two main services:

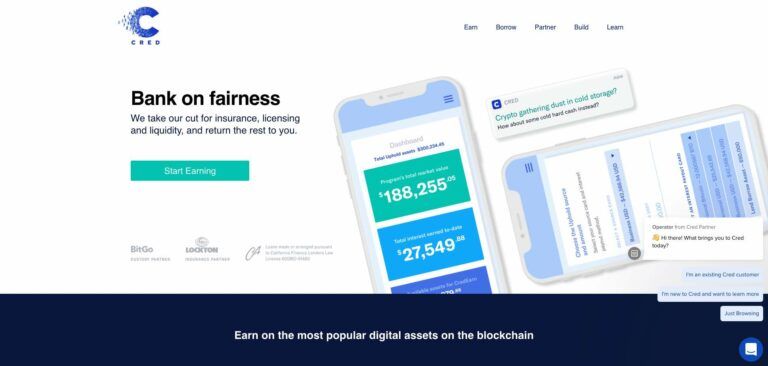

- Earn interest on cryptoassets you already own. Here is how this works: (1) You pledge any of over 29 cryptoassets you are HOLDing with one of Cred’s partners; (2) Your pledged cryptoassets accrue interest; Cred pays you interest monthly either in fiat or crypto.

- Borrow money using cryptoassets you already own as collateral. All you need to get cash loans with “sub-10% APR” is to “hold your crypto in your secure Cred Account.”

Huobi’s press release says that a new version of Huobi Wallet that supports this partnership with Cred is expected to launch late this summer.

He Huang, CEO of Huobi Wallet, had this to say:

“We are so excited to partner with Cred as we share a mutual vision to make our services more accessible to the users. And I believe our partnership will be further enhanced with their team experience and achievements in compliance.”

As for Dan Schatt, CEO and Co-Founder of Cred, he stated:

“We are thrilled to partner with Huobi, a highly popular cryptocurrency wallet across Asia. In times of financial instability, we’re delighted to assist a strong, reputable company, offering financial services to its customers.”

Featured Image Courtesy of Huobi Group