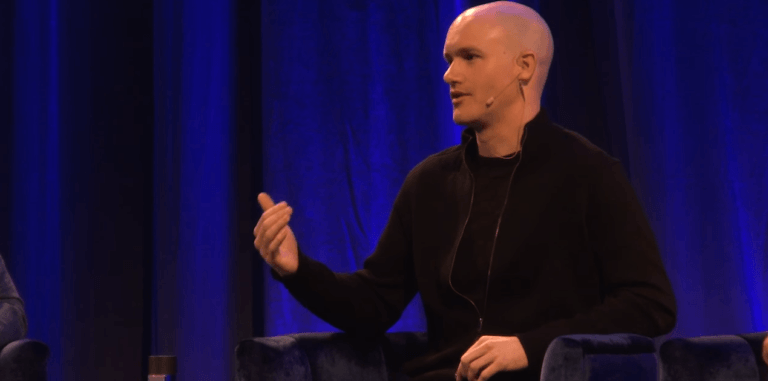

On Tuesday (March 3), Brian Armstrong, a co-founder and CEO of Coinbase, explained via a series of tweets how “a down stock market and interest rate cuts may lead to growth in crypto this year.”

Armstrong’s comments came shortly after the Federal Reserve (aka “the Fed”), the central bank of the United States, announced that it had cut its benchmark interest rate — i.e., the Federal Funds Rate — by 50 basis points (i.e. 0.5%) in an attempt to fight the threat posed to the U.S. economy by the COVID-19 outbreak. The Federal Funds Rate is “the interest rate at which depository institutions lend reserve balances to other depository institutions overnight on an uncollateralized basis.”

This was the first rate cut by the Fed since December 2008.

According to a report by CNBC, the Fed said in a statement:

“The coronavirus poses evolving risks to economic activity… In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate.”

Later, at a press conference, the Fed Chairman, Jerome H. Powell, stated:

“The magnitude and persistence of the overall effect on the U.S. economy remain highly uncertain and the situation remains a fluid one…

“Against this background, the committee judged that the risks to the U.S. outlook have changed materially. In response, we have eased the stance of monetary policy to provide some more support to the economy.”

Earlier on the same day, the Reserve Bank of Australia (RBA) had become the first major central bank to act. The RBA responded to the threat from the COVID-19 pandemic by announcing that it was dropping its benchmark cash rate by 25 basis points to a new record low of 0.50%, and central bank Governor Philip Lowe hinted that this might be not be the only rate cut this year:

“The global outbreak of the coronavirus is expected to delay progress in Australia towards full employment and the inflation target…The Board is prepared to ease monetary policy further to support the Australian economy.”

It was with these rate cuts in the background that Armstrong started his series of tweets

A down stock market and interest rate cuts may lead to growth in crypto this year. Governments around the world are likely to look to stimulate the economy in any way they can, including using quantitative easing and expanding the money supply (printing money).

— Brian Armstrong (@brian_armstrong) March 3, 2020

He then commented on China’s quantitative easing in February:

China has already done this, printing $173B. This may lead to a movement of funds into crypto, that are viewed as a hedge against inflation.

— Brian Armstrong (@brian_armstrong) March 3, 2020

Finally, he talked about how the recent falls in global stock markets and recent/upcoming by central banks around the world could cause a shift in how institutional investors look at cryptoassets:

This could be the year where the mindset of institutional investors begins to shift, from crypto as a venture bet, to crypto as a reserve currency.

— Brian Armstrong (@brian_armstrong) March 3, 2020