The Bitcoin Cash blockchain seems to have avoided a potential chain split over a proposed “miner tax” that was looking to fund the cryptocurrency’s developers.

As CryptoGlobe reported, the “tax” would see BCH miners donate 12.5% of the coinbase block reward to a Hong Kong-based corporation set up to legally accept and disperse the funds to fund developers. It was proposed by the CEO of the largest bitcoin cash mining pool BTC.TOP, Jiang Zhuoer, and supported by mining pools representing one-third of BCH’s hashrate.

These included BTC.TOP, Bitcoin.com, BTC.com, ViaBTC, and Antpool. The proposed tax was controversial, however, and even threatened to ‘orphan’ the mined blocks of those who didn’t follow the plan, setting the Bitcoin Cash community abuzz.

In response to the proposed tax and the threat of orphaning blocks – essentially removing them from the blockchain – an anonymous group of “North American and European miners representing 1.6 exahash/s” threatened to launch a hash war opposing the tax, which could lead to a chain split.

The group’s post reads:

Assuming the proposal is not withdrawn, or modified to be acceptable, we will continue to mine up to the hard fork, which will create our own chain after the fork due to the consensus rule change introduced by the signatories. We definitely plan to obtain more hashrate than the signatories can muster. The market will need to decide in the days following the fork.

In response to the threat of a chain split, Bitcoin.com changed its stance on the proposal, withdrawing its support for it until there’s “more agreement in the ecosystem such that the risk of a chain split is negligible.”

In its response, Bitcoin.com pointed out there’s a lack of clarity surrounding where the funds would go, and instead argues it would be better for developers to make it clear what they need funds for, providing budgets and timelines for their work.

We think the lack of clarity in this is one of the main drivers of confusion and contention around the various funding proposals. In venture capital, investors do not find talented technical individuals and hand them money to “do something.”

The anonymous group of miners threatening the chain split quickly edited their own post, clarifying they took notice of Bitcoin.com’s post and would no longer be pursuing a hard fork. For the time being the group will be supporting BCH, it added.

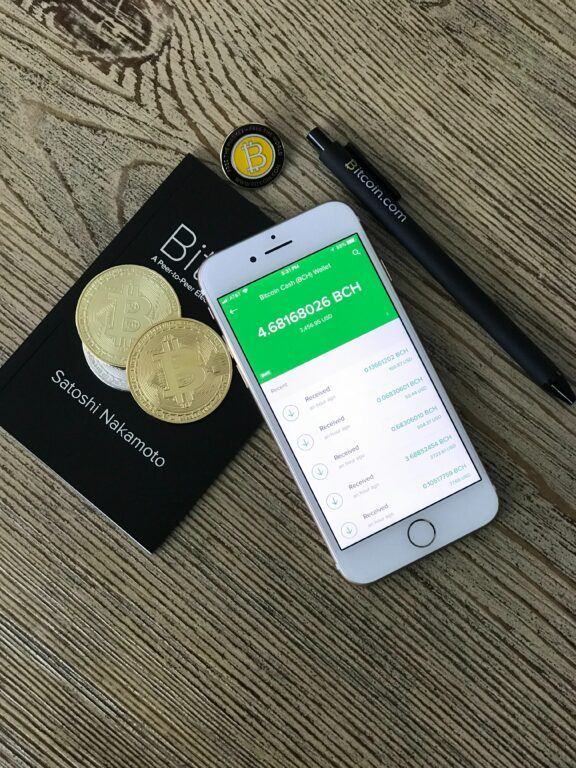

Featured image by David Shares on Unsplash.