Malta-based crypto exchange OKEx has announced that later this week it will be listing Tezos (XTZ).

The Tezos white paper says that Tezos is “a generic and self-amending crypto-ledger,” and that “Tezos can instantiate any blockchain based ledger.”

Tezos, which had its initial coin offering (ICO) in the summer of 2017, uses a Delegated Proof of Stake (dPoS) consensus algorithm.

According to its development team, Tezos offers three main benefits:

- Its native smart contract programming language, Michelson, makes it easier to do formal verification, thereby allowing for more secure, institutional-grade smart contracts.

- Its “formal upgrade mechanism” allows the network to stay relevant as better technology becomes available.

- All stakeholders may “participate in network upgrades by evaluating, proposing, or approving amendments.”

According to OKEx’s press release, the exchange will start accepting XTZ deposits from 09:00 UTC on 6 November 2019, and the spot trading in the two supported pairs–XTZ/USDT and XTZ/BTC–is expected to begin at 09:00 UTC on 7 November 2019. As for withdrawals, they will be enabled at 09:00 UTC on 8 November 2019.

Andy Cheung, Head of Operations of OKEx, had this to say:

Tezos is a highly respected project with a robust community, and we're happy to be able to add the value of the XTZ network to the OKEx ecosystem, where we strive to deliver a one-stop-shop for professional and retail traders.

As for Corey Soreff, who sits on the Board of Directors of Tezos Commons Foundation, he stated:

We are looking forward to a thriving relationship with OKEx, a global leader in the blockchain space, in furthering the Tezos ecosystem together in Asia and throughout the world.

It seems that this announcement by OKEx may have already helped the XTZ price. According to CryptoCompare, at the time of writing, XTZ is trading at $0.8718, up 0.58% in the past 24-hour period:

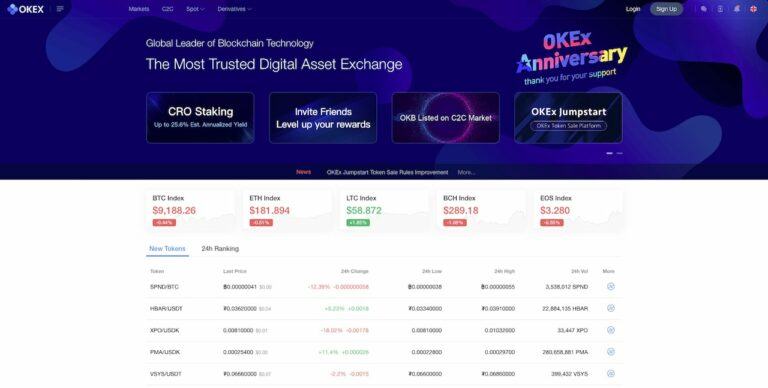

Featured Image Courtesy of OKEx