Treasury Secretary Steven Mnuchin said on Monday that the Libra Association was crumbling because it is failing to meet regulatory standards, and played down the role of recent warnings from members of Congress.

On Friday, key members of the Libra Association Visa, Mastercard and Stripe – all of whom received letters expressing “deep concerns” from Senators Brian Schatz and Sherrod Brown – announced, along with eBay, that they were withdrawing their membership. A week earlier, PayPal had also stepped down from the alliance.

Threatening

When questioned on CNBC’s flagship programme Squawk Box whether he thought the letters to Visa, Mastercard and Stripe from Schatz and Brown had been “threatening”, Mnuchin replied:

I wouldn't give them too much credit as we at Treasury sent them letters as well. I've met with representatives of Libra multiple times […] and made it clear to them that if they don't meet our standards with money laundering that we would take enforcement actions against them.

He added that the companies which have dropped out appear to have realised that the project’s compliance with the necessary regulatory standards has not been met. He concluded:

I think they realised they are not ready and I assume some of the partners got concerned and dropped out until they meet those standards.

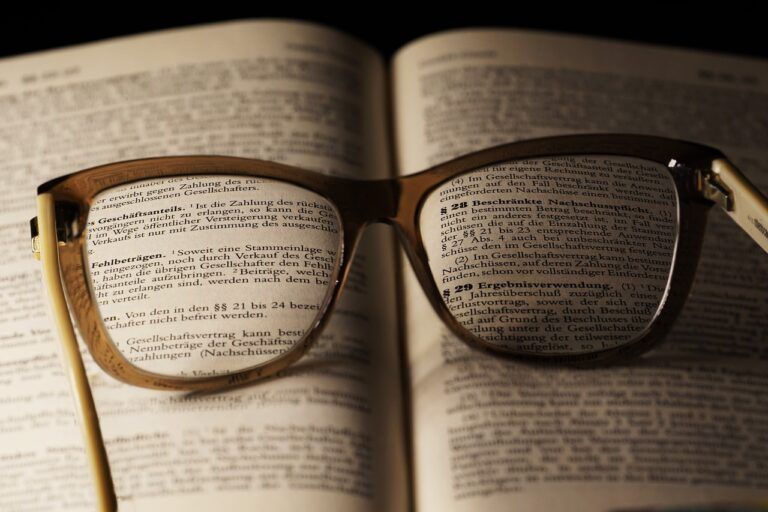

Featured Image Credit: Photo via Pixabay.com