Chainlink (LINK) has been on fire in the past couple of weeks, after being one of the few altcoins to break up inversely from Bitcoin (BTC) after the latter broke down. The winning altcoin still looks strong even as it approaches some resistance levels, and overbought conditions.

Starting on the daily LINK/BTC chart, we see that Chainlink has done nothing but plow ahead after Bitcoin’s dump. Within the most recent retracement range, LINK has powered through the “golden pocket” Fibonacci level, signaling the potential for enough strength to leave that structure on the upside.

If we go a bit deeper to the 12-hour chart, we see that the bullish picture generally does not change — but we also should consider a pullback in the shorter term. The RSI is on its second trip into overbought territory, and the histogram is flat with a MACD hanging in midair. There is also a picture of bear divergence generally on the histogram vis-a-vis price.

There is a good chance that LINK could get rejected at about 22,500 sats, and have to consolidate a bit before reattempting a break. Perhaps a retest of the 21 exponential moving average (EMA) is in order. Having said that, the EMA picture on the 12-hour is compelling, with a fully opened, bullish fan.

Finally, going one final layer down to the 4-hour, we see that a consolidation has in fact been going on on the histogram. Price is likely going to break soon, either up to 24,000 sats or down to the 55 EMA. We need to be looking for the end of this local uptrend — not the greater uptrend — and a retrace. It should either come now, or after 24,000 sats is reached.

In either case, the longer term price action of LINK seems clearly bullish, and it continues to look like the solid gold pick of 2019.

The views and opinions expressed here do not reflect those of CryptoGlobe.com and do not constitute financial advice. Always do your own research.

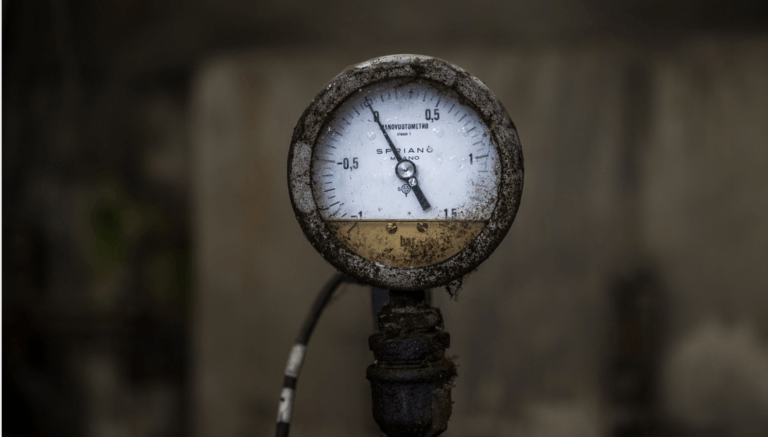

Featured Image Credit: Photo via Pixabay.com