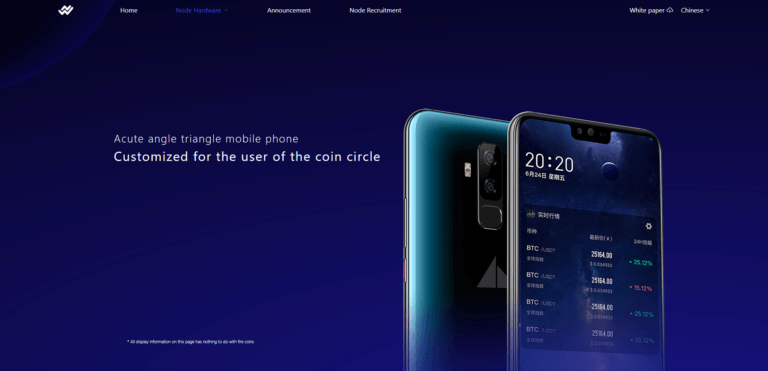

On Tuesday (September 3), Singapore-based crypto exchange Huobi Global (“Huobi”) announced that it will be listing NODE token, which is the native token of blockchain startup Whole Network (the maker of blockchain phone “Acute Angle”); the NODE token sale will be launched on IEO platform Huobi Prime on September 11.

Huobi will allow holders of Huobi Token (HT) to buy the Acute Angle blockchain phone using HT.

Acute Angle, which was developed in China and is currently available for sale there, will apparently be launched across Southeast Asia by the end of Q4 2019, and later on, there are plans to launch it in Europe and the U.S.

Huobi Global invested in Whole Network through Huobi Capital, its venture capital arm.

Livio Weng, the CEO of Huobi Global, had this to say:

We think blockchain phones are a promising area for future blockchain industry development. As the industry develops and as innovations like 5G become increasingly integrated into our telecommunications systems, we believe more and more crypto communities will want to trade and transact from mobile devices. Given this, the need for devices optimized for blockchain seems clear. This move is our first step to meet those user’s needs.

In a press release shared with CryptoGlobe, Huobi says that the Android-based Acute Angle, which costs $515, has “a wide range of features built with cryptocurrency traders in mind, including a programmable notification feature that alerts the user when certain market conditions are met, such as the price of a given coin rising or dropping.”

Also, the phone “incorporates an innovative mining/task reward feature that airdrops NODE to users simply for using and interacting with the crypto community with their Acute Angle phone.”

Furthermore, the Acute Angle “includes a built-in wallet app and an optional plug-in cold wallet; a wide range of pre-installed blockchain-related apps, including Huobi apps and crypto news apps; and a dedicated blockchain app store filled with a wide range of related apps and DApps.”

The Whole Network Acute Angle phone will be available from Huobi Global’s website “during a special sale between September 10 and 11.”

Here are some of the technical specifications of the Acute Angle phone:

- Operating System: Android 9.0

- CPU: Octa-core 64-bit 2.1GHz

- GPU: Arm Mali-G72 MP3

- RAM: 6GB

- Internal Storage: 128GB

- External Storage: Support for microSD (up to 256GB)

- Screen: 6.7-inch 19:9 FHD (1080 x 2280 pixels)

- Battery: 3900mAh

Featured Image Courtesy of Whole Network