This article explains what went wrong with the plans of LedgerX to launch in the U.S. on Wednesday (July 31) the first physically-settled Bitcoin futures product and examines the resulting aftermath.

New York City-based LedgerX LLC (“LedgerX”) is “the first federally regulated exchange and clearing house to list and clear fully-collateralized, physically-settled bitcoin swaps and options for the institutional market. “

In a blog post published on June 24, LedgerX CEO Paul Chou announced that LedgerX was the first company in the U.S. to obtain “formal regulatory approval to offer bitcoin spot and physically-settled derivatives contracts (including options, futures, and more), to retail clients of any size.”

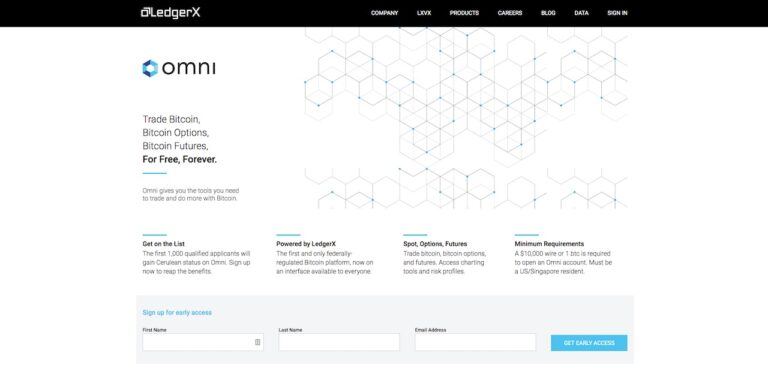

He went on to say that these products would be trading on “LedgerX Omni”, a new platform “enabled” by their Designated Contract Market (“DCM”) license.

On JUne 25, the U.S. Commodity Futures Trading Commission (CFTC) issued a press release that confirmed that it had approved LedgerX’s application for designation as a contract market.

But this press release did not stop there. It also said that:

- “LedgerX has been registered with the CFTC as a swap execution facility and derivatives clearing organization (DCO) since July 2017.”

- “Effective June 24, 2019, LedgerX is also registered as a designated contract market (DCM)…”

- “LedgerX has requested that the CFTC amend its order of registration as a DCO, which limits LedgerX to clearing swaps, to allow it to clear futures listed on its DCM.”

In other words, the CFTC explained that before LedgerX could “clear futures” on the Omni platform, it needed the CFTC’s approval for an amendment to its DCO license.

However, the LedgerX CEO’s blog post seemed to be saying that LedgerX had all the proovals it needed to offer physically-settled Bitcoin futures on Omni, and that LedgerX just needed some time to get this platform ready for a public launch:

We have the license, but we also have a long waitlist. On-boarding will be performed slowly and require your patience, to allow us to thoroughly test and monitor the technology systems throughout the process, and to make sure that the customer experience is outstanding.

Then, one week later, on Wednesday (July 31), Coindesk reported that they had exclusively been told by LedgerX that the company had “officially launched the first physically-settled bitcoin futures contracts in the U.S., beating the Intercontinental Exchange’s Bakkt and TD Ameritrade-backed ErisX to the punch.” The report also mentioned that it had just become possible for any U.S. resident with a government-issued ID to trade physically-settled Bitcoin futures.

Then, on Thursday (August 1), Coindesk reported that LedgerX had not launched Bitcoin futures (despite what had been claimed previously) and that the CFTC had said that it had not given LedgerX permission to do so.

This Coindesk report went on to say that according to CFTC regulations (Title 17 part 39.3), “the agency has 180 days to approve or deny a DCO application.” The LedgerX CEO told Coindesk on Thursday:

[The CFTC] said to clear swaps and they said later that [we] should actually clear futures too and … we were waiting essentially for this amendment.

Coindesk believes that Chou was implying that LedgerX had assumed that the CFTC had implicitly approved the required amendment to LedgerX’s DCO license since over 180 days had passed since LedgerX had submitted its application for the amendment.

But the unnamed senior CFTC official who spoke to Coindesk disagrees with Chou’s understanding of the situation:

Every new or amended DCO application needs to be affirmatively approved by the Commission. The absence of a decision does not constitute approval, and entity self-certification is not an option.

Coindesk later updated this article to say that:

- The LedgerX CEO had, via Twitter, “threatened to sue the regulatory agency for ‘anti competitive behavior, breach of duty, [and] going against the [regulations]’.”Ryan Gorman had

- LedgerX’s press representative, Ryan Gorman, had told Coindesk that he would “no longer be representing the company as of Thursday over ‘concerns‘ about the events of the last 24 hours.”

Featured Image Courtesy of LedgerX