HDR Global Trading Limited (“HDR”), the Seychelles-based company that operates BitMEX, the world’s largest crypto derivatives exchange, has decided to bar people resident in “the jurisdictions in which HDR-affiliated employees and offices are located” from accessing BitMEX.

BitMEX’s blog post, which was published on Monday (August 19) says that it has been “working with regulators to help shape the industry, creating the standards that will help it go mainstream,” and that it “welcomes” the “increased involvement of regulators with all the major players in the industry.”

BitMEX says that, due to this regulatory oversight, it envisions “a new era of legitimacy for cryptocurrency exchanges: a future where market operation standards are clearly stated and maintained, where security is paramount, and where financial reserves are independently and frequently audited.”

In order to ensure “the safety of your funds and the stability of the platform,” HDR has decided to add Seychelles, Hong Kong, and Bermuda to its list of restricted jurisdictions.

Also, BitMEX says that it is “working on independent audits of our Insurance Fund, market making activities, and tradeable contract structure,” and intends to “share the results of these processes in the near future.”

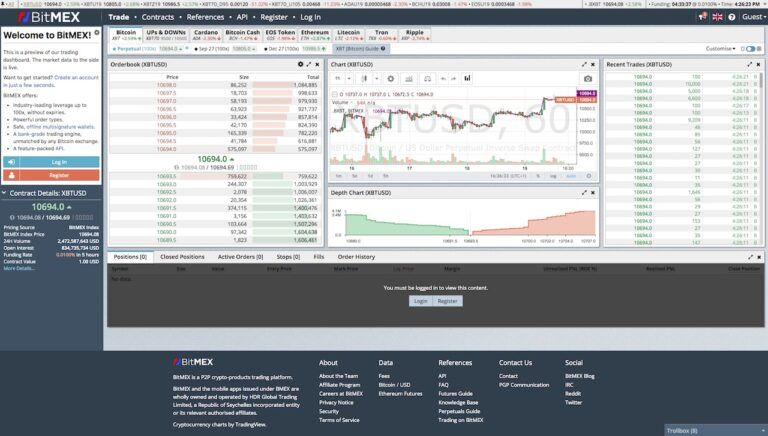

Featured Image Courtesy of BitMEX