The popular Opera browser, which reportedly has over 300 million users, is reportedly soon adding support for TRON’s TRX on its crypto wallet, as part of a plan to support ‘multiple blockchains’ in the next 12 months.

According to a press release shared with CryptoGlobe, the integration is going to see Opera users be able to natively use TRON-powered decentralized applications (dApps) within the browser, and store TRX and TRC-standard tokens in the browser’s built-in cryptocurrency wallet.

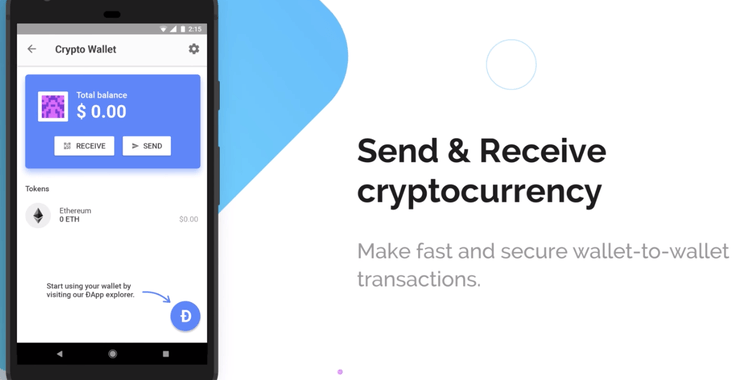

Until now, Opera’s wallet only supported the Ethereum blockchain, meaning users could only store ether and ERC-20 tokens on it. It was introduced back in July of last year, and launched on Opera’s main Android browser in December. The wallet has also been added to Opera’s desktop browser.

Commenting on the addition, TRON Foundation CEO Justin Sun stated:

We are excited that Opera, a mainstream browser with hundreds of millions of users, will now seamlessly support TRX and other TRON tokens. Soon, Opera users will be able to use dApps on the TRON blockchain.

Contacted by The Next Web on whether there was demand to support the TRON blockchain, Opera revealed “TRON is one of the fastest developing blockchains with plenty of dApps so it’s a logical step” to add it, as it aims to grow the dApp ecosystem.

The decision is notable, as a researcher has earlier this month found a critical TRON bug that could’ve crashed the entire blockchain. The bug has since been fixed. Opera’s move is reportedly part of a wider rollout that’ll see it add “support for multiple blockchains within the next 12 months.”

Which cryptocurrencies the Norwegian browser developer will add or when TRON support will be rolled out is currently unclear. It’s worth noting that earlier Opera partnered with HTC to build a seamless wallet experience for the firm’s blockchain phone users.