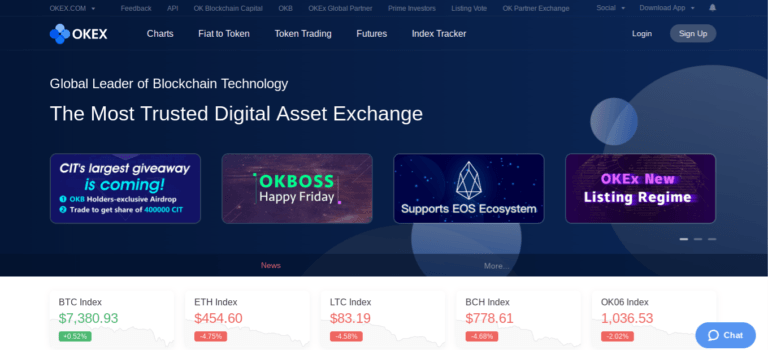

Amid the crowded field of cryptoasset exchanges, one of the most exciting and ascending platforms is OKEx. A fully-fledged exchange complete with hundreds of trading pairs, OKEx offers a world-class trading platform that goes toe to toe with any other exchange out there in terms of liquidity, speed, trading tools, and user experience. Any experienced crypto trader or investor will quickly see its worth after a brief test drive.

OKEx has another feature that no one else currently offers as it is the only cryptoasset exchange currently offering spot, margin, and derivative trading all under one roof. Futures contracts, perpetual contracts, and leveraged positions sit side-by-side with fully featured spot trading, along with a dizzying array of trading tools to complement it all.

This guide will detail how to get set up on OKEx, and some of the features of both spot and derivative trading on the exchange.

Getting Set Up

Getting set up is pretty easy, resembling the process of other popular exchanges. There is some KYC/AML involved, and US customers (and some other countries and jurisdictions) are currently not permitted to trade on the platform.

Users can sign up and send assets to the exchange, and even trade without any KYC/AML involved. But this is not recommended, because any amount of withdrawal will require the basic first tier of identification using a government-issued identity document.

The entire interface is fast, comprehensive, and attractive (there is a dark mode!). The trading page offers both a proprietary chart which is light and fast – and complete with all the basic tools like channels and Fibonacci retracements – and also a TradingView integrated chart with all the features that entails. Sixty levels of the order book are visible, down to a ten-satoshi price step, as well as the sixty most recent transactions. It leaves nothing to be desired, is well laid out, and completely intuitive.

There are seven order types in total, probably more than you will ever use. Besides limit and market orders, there are stop and conditional orders, trailing stop, and advanced limit orders with high level trading options; Fill or Kill, Post Only, and Immediate or Cancel. This is the full gamut of trading options – a trader’s exchange through and through.

5X margin is available to trade a modest selection of the hundreds of spot pairings, with all of the biggest cryptos available to trade with leverage. But the fireworks happen in the derivatives section.

Both the futures and swaps trading sections feature a mandatory knowledge test before users are able to trade derivatives. OKEx requires, as is the case in traditional finance, that users enter the market as informed customers.

These quizzes help users understand funding, margin calls, liquidations, and – important – the withdrawal schedules.

The tests are not very hard, of course (although they are not completely easy, either, if you’re not cheating), but they ensure that users have a basic understanding what they’re getting into when trading derivatives. It is rather impressive.

Minimum leverage rates are rather high, offering little flexibility in this regard. Weekly, bi-weekly, and quarterly contracts are traded at a minimum of 10x leverage. This, perhaps one of the only downsides to futures trading here, is a far cry from the more flexible leverage rates of some other exchanges – because 10x positions can be tricky to trade.

However, the perpetual swap option alleviates this problem. The leverage slider is fully fluid, from the going-to-“cash” 1x option all the way to the I-lost-my-nestegg 100x option (don’t do it).

When it comes to derivatives, one way in which OKEx differs from competitors is that all the swap options available (there are 9) are funded using their actual base coins. Litecoin contracts require a Litecoin principal, Ethereum Classic requires ETC funding, etc. Although less flexible than trading it all with Bitcoin funding, as on BitMEX you don’t have to price-in the exchange rate between BTC and the underlying asset.

For some readers, everything written in the above few paragraphs may be gobbledigook. OKEx has these individuals covered as well, with a comprehensive beginner’s guide.

This is an interactive, completely visual, completely idiot-proof example of how margin trading works. The directions talk you through it, and let you execute a sort of choose-your-own-adventure play trade. And even if you already know how it works, it’s pretty entertaining to click through.

Finally, as if all of this were not enough, OKEx also allows trading with six different fiat currencies against a number of high-cap cryptos in the so-called C2C section (“c” for customer, instead of P2P). This exchange allows direct trade between OKEx customers, in Euro, Renminbi, Vietnamese Dong, Pounds, Rubles, and Turkish Lira. And if there is foul play between customers, OKEx will mediate trade disputes.

Anyone who has been trading or investing in cryptos for some length of time will be impressed by OKEx. It has everything you ned, from the simplest to the most advanced kind of trades. It has swaps, futures, a margin trading. It has fiat gateways. It has massive liquidity. It is beautiful, and fast, and intuitive. A lot of work has gone into building this platform and ecosystem, and it shows.