Bithumb, one of South Korea’s largest cryptocurrency exchanges, has reportedly had a net loss of 205.5 billion won, the equivalent of $180 million, in 2018’s bear market. The loss was attributed to hacks to suffered, infrastructure investments, and labor costs.

According to BTCKorea, the company behind Bithumb, the main factor behind 2018’s losses was the year-long bear market the cryptocurrency ecosystem endured, which affected most companies in the sector.

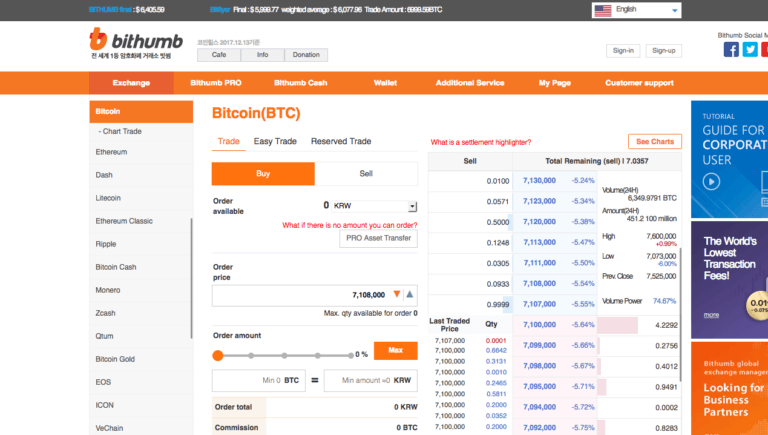

CoinDesk Korea reports the figure is significant, as in 2017 the cryptocurrency exchange had a net profit of 534.9 billion won ($469 million). Despite the different, Bithumb’s revenues grew roughly 17.5% from the equivalent of $292.3 million to $343.4 million.

The trading platform’s operating profit declined by 3.4% to the equivalent of $224.5 million, from $232.5 million in 2017. Its operating expenses nearly doubled when compared to 2017, while its non-operating expenses skyrocketed from the equivalent of $3.6 million to $334.8 million.

Bithumb’s Struggles

Notably, Bithumb has been hacked twice in the last few months. The first time it saw hackers take over $30 million worth of cryptocurrencies from its wallets, in June of last year. The exchange later on claimed to have recovered $14 million worth of the hacked funds.

The second security breach occurred last month, when around $13 million worth of EOS and $6.2 million worth of XRP were taken from its hot wallets. Since the breach, the company has started moving funds to cold storage wallets, and checking its users’ balances.

[Notice🔔]

We would like to ask you to stop making deposits of cryptocurrency in order to check our member's assets through external organization.

For more details >> https://t.co/EqNWak0tz8— Bithumb (@BithumbOfficial) April 2, 2019

The South Korean exchange is reportedly planning on cutting its staff by up to 50%, from 310 employees to 150, in order to further cut costs. Despite its poor results Bithumb earned last year the title of largest cryptocurrency exchange, even though it acquired it through “incentivized trading.”

Its trading volumes surged after Singapore-based BK Global Consortium acquired a controlling share in the exchange for $350 million. The firm reportedly implemented a “series of airdrop competitions, raffles, rebates, and other programs” to bring in non-Korean users.

The move led to wash trading allegations based on suspicious activity going on at the exchange, which stopped soon after it made headlines. This activity involved tremendous trading volume on little-known cryptocurrencies, and an odd trading pattern on popular trading pairs.