Like many other people, Masayoshi Son, the Japanese multi-billionaire reportedly got caught up by Bitcoin fever in late 2017, and decided that it was better to show up late at the party than not at all. So, he gambled, and placed a big personal bet on Bitcoin out of fear of missing out (FOMO). This bet ended up costing him $130 million.

The SoftBank Group (“SoftBank”) is “a Japanese multinational holding conglomerate headquartered in Tokyo, Japan.” Its holdings include stakes in Alibaba, Arm Holdings, Boston Dynamics, Sprint, Uber, WeWork, and Yahoo Japan. Also, it “runs Vision Fund, the world’s largest technology fund.”

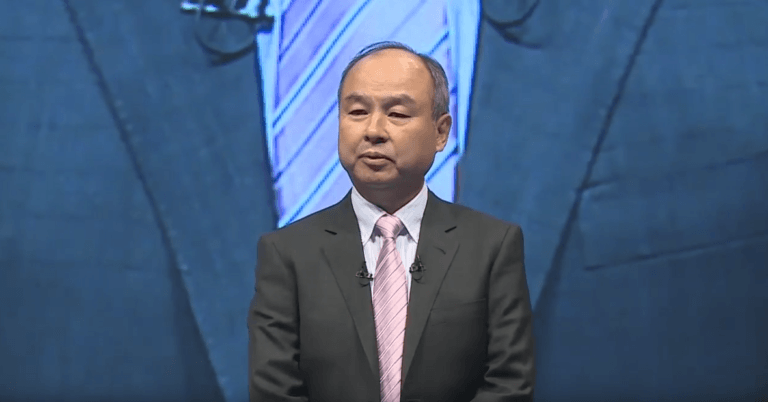

The fourth-largest publicly traded company in Japan was founded in September 1981 by 61-year-old Masayoshi Son, who is also currently the company’s CEO. Earlier this month, Forbes placed him at #2 in their list of “Japan’s 50 Richest People”, with a personal net worth estimated to be $24 billion.

According to a report published on Tuesday (April 23) in the Wall Street Journal (WSJ), the legendary technology investor made an investment in Bitcoin in late 2017 upon the recommendation of Peter Briger, the co-chairman of global investment management firm Fortress Investment Group (“Fotress”); at this time, Softbank was in the process of acquiring Fortress (the acquisition process had started on 15 February 2017, and was completed on 28 December 2018).

BREAKERMAG says that the reason that Briger was so bullish on Bitcoin was that Fortress “had been investing in bitcoin since 2013, and by late 2017 was seeing absolutely unheard-of returns on that investment.”

Unfortunately, by early 2018, the price of Bitcoin had dropped so much that Mr. Son decided that he needed to liquidate all of his Bitcoin holdings, even if it came at a cost of $130 million. As the WSJ report points out, this “previously unreported bitcoin loss shows that even some of the world’s most sophisticated and wealthiest investors got caught up in the frenzy.”

Of course, if you talk to another legendary technology investor, Tim Draper, he will tell you that he is confident that the Bitcoin price will reach $250,000 by 2022-2023, a prediction he reiterated in an interview on April 2, and he will probably also tell you that had Mr. Son not panicked and HODLed, his Bitcoin investment could have become another one of his great investments.