Changpeng Zhao (“CZ”), co-founder and CEO at Binance, seems to be trying to temper expectations for his company’s highly anticipated new blockchain by pointing out that although some existing projects that currently run on Ethereum may want to migrate to Binance Chain to take advantage of its greater speed, it should not be considered an “Ethereum killer”.

What is Binance Chain?

This is what the Binance team wrote about Binance Chain on 13 March 2018, the day that the development process for this project was officially launched:

“As a public blockchain, Binance Chain will mainly focus on the transfer and trading of blockchain assets, as well as provide new possibilities for the future flow of blockchain assets. Binance Chain will focus on performance, ease-of-use, and liquidity. Binance Coin (BNB) will be upgraded to exist on its own blockchain mainnet, becoming a native coin. At the same time, Binance will transition from being a company to a community.”

According to the documentation provided by Binance, the following were the main design goals for Binance Chain and Binance DEX (a decentralized exchange powered by Binance Chain):

- “No custody of funds: traders maintain control of their private keys and funds.”

- “High performance: low latency, high throughput for a large user base, and high liquidity trading. We target to achieve 1 second block times, with 1 confirmation finality.”

- “Low cost: in both fees and liquidity cost.”

- “Easy user experience: as friendly as Binance.com.”

- “Fair trading: minimize front-running, to the extent possible.””Evolvable: able to develop with forever-improving technology stack, architecture, and ideas.”

If you are wondering what you can do on Binance Chain, here is the answer:

- “Send and receive BNB”

- “Issue new tokens”

- “Send, receive, burn/mint and freeze/unfreeze tokens”

- “Propose to create trading pairs between two different tokens”

- “Send orders to buy or sell assets through trading pairs created on the chain”

Why Are Many People So Excited About Binance Chain?

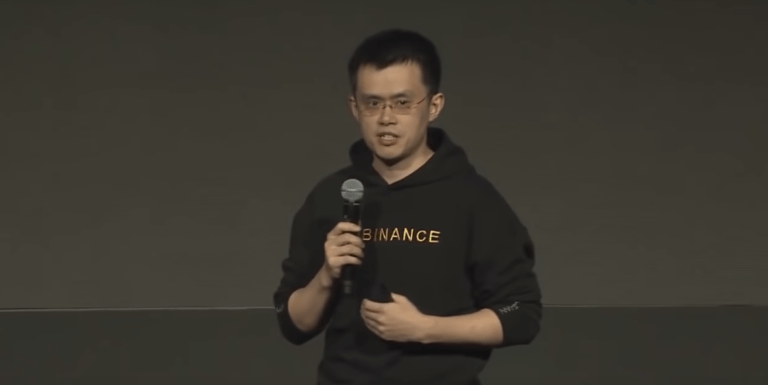

Well, here is what CZ himself said about Binance Chain back on March 5 during his second Ask Me Anything (AMA) session on Periscope:

“The Binance Coin will migrate to the Binance Chain as a native coin. We are also encouraging other ERC-20 tokens to migrate to Binance Chain. There are many benefits for doing that… Binance Chain is a faster chain… It's super easy to create a token on Binance Chain… There's no smart contracts to program… It's more secure… There's less room for bugs… There's about eight projects already confirmed for migrating to Binance Chain from ERC-20… These are not small projects.”

And this is what Binance apparently told CCN in an interview about Binance Chain and Binance DEX:

“Binance Chain was created to support the issuance and exchange of digital assets. Any project can issue new tokens on Binance Chain, and existing tokens that don’t depend on smart contracts are welcome to migrate to Binance Chain, to natively exchange on Binance DEX and gain the benefits from this low latency and high throughput network.”

CZ’s Comments About Binance Chain and Ethereum

On Thursday (April 18), after seeing CCN’s tweet about a Binance-focused article by journalist Joseph Young, CZ sent out the following reply:

Thanks for the nice article! But almost too supportive. lol. @Binance_DEX does not challenge Ethereum, it doesn't even have smart contracts. It challenges ourselves, exchanges. 🙂

— CZ Binance (@cz_binance) April 18, 2019

CZ says two very interesting things in this tweet:

- Binance Chain/DEX “does not challenge Ethereum”

- Binance Chain/DEX “challenges ourselves, the exchanges”

It is true that Binance Chain and the Ethereum blockchain are very different beasts. Here are a few key differences in which the former differs from the latter:

- Less decentralized. As CZ acknowledged in his first-ever AMA session on February 7, Binance Chain will start with a small number of validator nodes (around 11), and Binance will have control over the network:

“Like EOS, we’re looking for guys who can run very fast validators and that can protect the validators from DDoS attacks and other things. So initially, the nodes will be selected through our close partners, but over time we will increase the number of validator nodes.”

“Do we have a lot of influence over the network and the validators? Yes, we do. So initially, we want the chain to be more centralized in that way, compared to other networks, we’ll have a little bit more influence. But I think it’s important for us to maintain that influence in the early stages. As time goes on, more and more validators are going to join, and our influence will decrease.”

- Different Consensus Algorithm. Binance Chain uses Tendermint’s consensus algorithm which offers much higher performance, a lot more scalability, and much lower time to settlement finality than Ethereum’s Proof-of-Work (PoW) based consensus algorithm.

- No support for smart contracts. Binance Chain was built for speed rather than flexibility so that Binance DEX could handle the same kind of loads as Binance’s centrallized exchange platform. Here is CZ talking about this in more detail:

“Cosmos had the closest thing we were looking for. They had a solid product, the Cosmos architecture was the closest to what we wanted. What we did is, we took Cosmos — well, we took Tendermint, really, and we made a fork out of it. So we didn’t use the standard SDK, so we forked it and chopped a lot of things out. So, in the Binance Chain, there’s no smart contract. We just have an interface for you to issue tokens, and then you can trade it. Binance Chain is a very simple chain in terms of application, but it can handle very large loads. It is our opinion that the load is more important than the features.”

Two days after CZ tweeted about Binance Chain not really challeging Ethereum, he once again reminded everyone that Ethereum offers a lot more flexibility than Binance Chain when he corrected Twitter user “@LarssonFuture” who had written why would any new projects chose to use Ethereum for issuing their (ERC20) tokens when they could just use Binance Chain and take advantage of all the benefits it offers:

ETH can do a lot of other things Binance Chain can't. @Binance_DEX just specialize on one use case.

— CZ Binance (@cz_binance) April 20, 2019

However, not all existing projects that currently run on Ethereum need Ethereum’s much greater flexibility. So, in some cases, despite what CZ says, Binance Chain is a competitor to Ethereum. Also, as Multicoin Capital Management explained in its excellent extensive report on Binance Coin in February, Binance DEX, by virtue of the fact that it is powered by Binance Chain, addresses some of the key problems with Ethereum-based DEXs.

As for Binance Chain/DEX presenting a challenge to existing crypto exchanges, it is hard to argue with this since what has happened in recent years with centralized exchanges such as Mt. Gox, Bitfinex, Cryptopia, and Quadriga, is slowly causing users of centralized exchanges to realize that it is much safer for them to maintain control over their cryptoasset holdings at all times, and so, although DEX trading volumes are currently much less than those on centralized exchanged, over time, many people expect DEXs to grow in popularity.