On Thursday (April 11), Coinbase announced a new Visa debit card for its UK and European Union (EU) customers that lets them easily spend any of the crypto balances in their Coinbase account for paying for goods/services anywhere that Visa is accepted or for making cash withdrawals from ATMs.

Appropriately enough, the new “Coinbase Card” was announced on the same day that Coinbase’s previous attempt at a crypto-to-fiat Visa debit card, the “Shift Card”, which was only for U.S. customers, is supposed to stop working (since that program has now been “retired”).

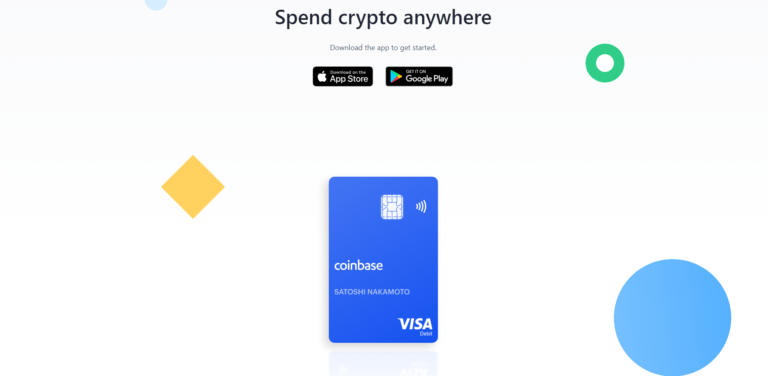

Here is everything you need to know about the Coinbase Card:

- The Coinbase Card is being launched today for UK customers only, but Coinbase does “plan to support other European countries in the coming months.”

- This is apparently the first debit card “to link directly with a major cryptocurrency exchange” in the EU.

- To apply for the Coinbase Card, Coinbase customers need to download the Coinbase Card app from iOS’s App Store or Android’s Play Store. (If you are based in the UK and do not see these apps in the aforementioned places, try using the links on the Coinbase Card website.)

- In the UK, the Coinbase Card has a GBP 4.95 “issuance fee” (which is waived “for the first 1,000 people to join the waitlist”).

- You can spend any cryptocurrency that is supported by Coinbase.com in the jurisdiction that you live in, as long as you have a non-zero balance in the wallet for that cryptocurrency in your Coinbase.com account. (An up-to-date list of supported digital assets is available in the Support section of the Coinbase website.)

- When you wish to use your Coinbase Card, to pay for something or to get a cash withdrawal from an ATM, you need to use the Coinbase Card app to select which crypto wallet in your Coinbase.com account is to be used for that transaction, at which Coinbase will then perform an automatic conversion from that cryptocurrency to fiat currency (e.g. GBP).

- For “domestic” (i.e. within your home country) purchases, the “crypto liquidation fee” is 2.40% of the transaction amount.

- Currently, there is a daily spending limit of GBP 10,000 (but Coinbase might agree to increase this limit for you if you contact card support services). There is also “a monthly purchase limit of £20,000 and a yearly purchase limit of £50,000.” Finally, the daily ATM withdrawal limit is GBP 500.

Featured Image Courtesy of Coinbase