On Wednesday (April 17), Coinbase announced that it was making its crypto-to-crypto services available to 11 more countries via its Coinbase Consumer (Coinbase.com) and Coinbase Pro platforms.

Coinbase was founded in June 2012. In October of that year, it started operating as an exchange by providing a way for users to buy and sell Bitcoin (BTC) via bank transfers. It was not until 17 December 2018 that Coinbase offered consumers a crypto-to-crypto trading service: Coinbase announced on this day that it had started the rollout of a new feature (“Convert”) that allows users of Coinbase Consumer (Coinbase.com) and Coinbase’s mobile app to directly convert between any two of six supported cryptocurrencies.

The great thing about this feature was that it is quicker and cheaper than having to do two separate transactions (i.e. selling the first cryptocurrency to get fiat and then using fiat to buy the second cryptocurrency).

The six supported cryptocurrencies were Bitcoin (BTC) and Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), 0x (ZRX), and Bitcoin Cash (BCH). Initially, this feature was only available in the United States, but Coinbase did promise (via a blog post about this feature) that it would be ‘”gradually rolling out the ability to convert cryptocurrencies to customers in all 34 countries in which Coinbase offers native payment access.”

Well, on Wednesday, Coinbase announced via a blog post that it was expanding its operations to 11 more countries. People in these countries, which are in the Asia-Pacific region and in Latin America, will now be able to ” store, trade, send, and receive cryptocurrencies on Coinbase Pro and Coinbase.com.” The eleven countries are Argentina, Mexico, Peru, Colombia, Chile, India, Hong Kong, South Korea, Indonesia, the Philippines and New Zealand.

Binance has demonstrated better than any other exchange the popularity of crypto-crypto trading among consumers and, of course, not having to deal with fiat currency makes it much easier for crypto exchanges to expand operations across the world. In fact, as Binance CFO Wei Zhou told Coindesk on Wednesday, although two years ago, “90 percent of trading was fiat to crypto,” today, “90 percent is crypto-to-crypto.”

Coinbase seems to have also noticed this trend:

“Direct trading between cryptos is increasingly the new norm and in the last year has overtaken traditional fiat to crypto trading across the globe.”

Coinbase also makes the following observation:

“As crypto moves from the current 'investment phase' into what we call the 'utility phase,' a host of new use cases will present themselves. This could take the form of decentralized versions of traditional financial services like lending or micropayments or truly novel crypto applications that no one has even thought of yet. The ability to convert from one crypto to another will form the backbone of this new decentralized economy.”

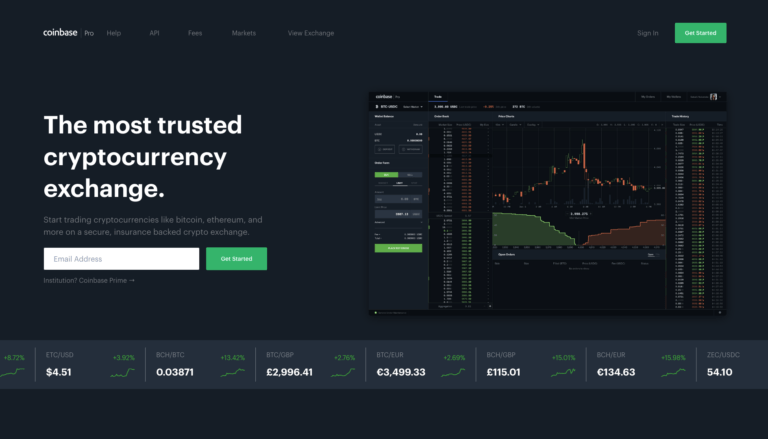

All Images Courtesy of Coinbase