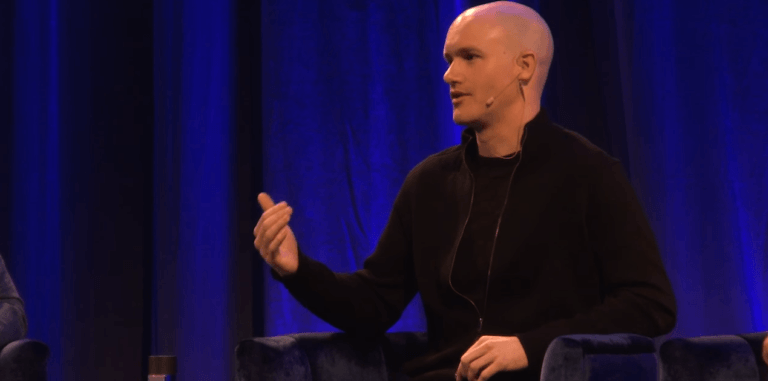

Earlier this week, Brian Armstrong, Co-Founder and CEO of Coinbase, held an Ask Me Anything (AMA) session on YouTube. This article looks at some of the main highlights:

What Is Needed for Crypto Achieve Mainstream Adoption?

“I think there’s three things in my mind. First one is volatility. Second one is scalability. Third one is usability.

Volatility

If crypto is wildly swing all over the place, it’s going to be harder to use as a real medium of exchange. And stablecoins are helping with that. The other thing that’s going to help with that is more and more real uses in the real world happening so that these crazy bubbles that go up and down and all the speculation in crypto will kind of get dampened out if we drive the utility phase.

Scalability

So, luckily, there’s now 5-10 really well-funded teams out there working on all kinds of solutions from layer 2 solutions like Lightning Network to next-gen protocols, and so a lot of these are going to be coming out and continuing to grow in the next 6-12 months. I think once we do that, we need crypto be not just, you know, 5-10 transactions a second, but in the order of 500-5000 a second to be like PayPal or Visa levels. That would allow us to get an app with 100 million people using crypto.

Usability

There’s still a lot of challenges there. You can imagine in a lot of these apps that are out there… It’s still too complicated to go there, be able to sign in… It should work like WeChat or something like that where when you go to the app, it already knows who you are and it has your payment method already attached and with one tap, you can then complete an action or complete a payment…”

Why Doesn’t Coinbase Pro Provide More Advanced Yet Relatively Basic Trading Features Such As Average Position Entry and P&L?

“Well, that’s a great point. P&L is on the roadmap. That’s something we’ve been trying to get on there for a long time. You know, some of these other ones, like average position entry, if you all want to see it, we’d love to hear it.”

What Are Your Thoughts on the Future of Crypto Mining and Proof-of-Work?

“Proof-of-Work is still the most trusted thing that came out, and it stood the test of time. That was like a brilliant invention in the original Satoshi white paper that kicked off this whole revolution. So, I don’t think that’s go away anytime soon, especially in Bitcoin, but a lot of these next-gen protocols are experimenting with Proof-of-Stake, and you know, there are some benefits there — the energy usage or the scalability — so, my hope is that as industry, we can just keep innovating.”

Who Are You and What Motivates You to Stay in Crypto?

“I’m basically nerd that likes to build stuff with technology… At this point, I’m just enjoying the process of learning. I am also a lifelong learner. Coinbase has been this crazy wild ride. We have 750 employees now. Every month, I have to learn some new skill… So, in that sense, it’s been really rewarding.”

Why Add Assets That Tarnish the Brand?

“Here’s the way I think about this now. I think about it a lot like Google or Amazon… The general idea is everything that’s not a scam or harmful to people should be added, but we should give people ratings and ways for them to evaluate these different tokens and coins.”

The video of the full AMA session is available on Coinbase’s YouTube channel.