Bitcoin (BTC) price today (3 April) has continued its shocking rise, after a 2 April breakout that may well be remembered one for Bitcoin’s history books.

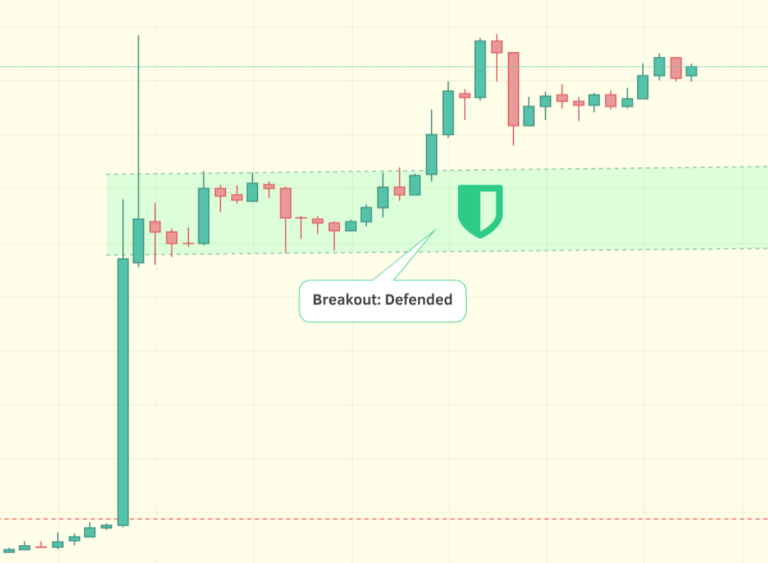

Specifically, Bitcoin has defended the 2 April gains beyond anyone’s wildest hopes, putting down a very secure daily candle well above reasonable support/resistance (S/R) zones.

As I covered in yesterday’s (2 April) price analysis, the end of the first daily (UTC time) candle on BTC’s chart was a crucial indicator for assessing the health and sustainability of the breakout. I estimated that holding above $4,600-ish would be the best case scenario, while holding at least within $4,500-300 would still be encouraging.

(source: TradingView.com)

(source: TradingView.com)

Bitcoin has completely surpassed even these demanding targets, by closing 2 April (UTC time) at $4,900. This is extremely encouraging, and suggests that this rally will actually be held. What’s more, this $4,900 mark seems to have become support, after one retest was stopped hard precesily in this zone. This retest came after another break up from a bull flag that had formed.

(source: TradingView.com)

(source: TradingView.com)

This confidence has given altcoins – as predicted – a massive runway to take off from. Litecoin (LTC) and Bitcoin Cash (BCH) have all followed bitcoin making shocking gains in the last 24 hours.

(source: CryptoCompare)

(source: CryptoCompare)

(source: CryptoCompare)

(source: CryptoCompare)

Ethereum’s (ETH) gains have been slightly more moderate.

(source: CryptoCompare)

(source: CryptoCompare)

Resistance

Where will Bitcoin end this uptrend? Many are speculating that the 21 month EMA (or, exponential moving average) trend line will form a strong resistance which will ultimately contain Bitcoin.

This moving average, seen below, perfectly held BTC above $6,000 during all of 2018. Given that previous support forms future resistance, it is likely that Bitcoin will be contained at the 21 mark, if it gets there.

(source: TradingView.com)

(source: TradingView.com)

What’s more, at least one analyst believes that Bitcoin will repeat its own history, and return to retest the low $3k’s. This is because, back in 2015, Bitcoin bounced off of this exact level in an effort to leave its then bear market. It failed to break the 21 and returned to retest the bear market lows.

(source: TradingView.com)

(source: TradingView.com)

At this point, however, such opinions are becoming minority.

Whodunnit?

The inevitable turn of conversation in moments like these, is the question of why? What caused the price pump?

CryptoGlobe reported today on a coordinated “single order” of 20,000 bitcoin (worth about $100 million) accross several exchanges, which was responsible for kicking prices above the critical $4,200 mark. As CryptoGlobe had also covered at length, this critical area was the very top of a months-long uptrend, and it looked more likely to correct down from there. Whoever placed these orders, however, had other ideas for the leading crypto.

(The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.)