BTCUSD Medium-term Trend: Bullish

- Resistance levels: $7,000, $7,200, $7,400

- Support levels: $5,000, $4,800, $4,600

Last week, April 2, the price of Bitcoin had a price breakout. The bulls broke the $4,255 resistance level which had remained unbroken since November 28, 2018. The bulls have tested the resistance level on four occasions but were unable to break it. The price rally has made Bitcoin’s price to appreciate in value.

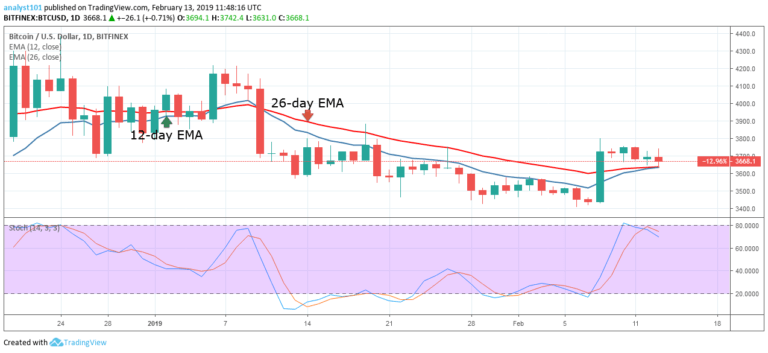

The BTC price is above the 12-day EMA and the 26-day EMA which indicates that price is likely to rise. A trend line is drawn to technically determine the duration of the bullish trend. If the bullish trend is ongoing the bullish candlesticks will be testing and trending on the trend line.

On the other hand, if the bullish trend is terminated, a bearish candlestick will break the trend line. Also, another candlestick will close on the opposite of it which confirms the termination of the current trend. Presently, the bullish trend is ongoing and the price is approaching the $5,258.80.

On the upside, a sustained price above the EMAs will enable the crypto to reach the highs of $5,500 or $6,000 .Meanwhile, the stochastic indicator is at the overbought region but above the 80% range which indicates that the crypto is in a strong bullish momentum and a buy signal.

BTC/USD Short-term Trend: Bullish

On the 4-hour chart, the price of Bitcoin is in a bullish trend. The crypto’s price is trending above the 12-day EMA. On April 4, the bears broke the 12-day EMA but the bulls recovered immediately and pulled above the 12-day EMA. On the upside, as long as the price is above the EMAs, the price will rise.

On the other hand, if the bears break below the EMAs, the crypto’s price will fall. Meanwhile, the stochastic indicator is at the overbought region but below the 80% range which indicates that the crypto is in a bearish momentum and a sell signal.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.