BTCUSD Medium-term Trend: Bullish

- Resistance levels: $7,000, $7,200, $7,400

- Support levels: $5,000, $4,800, $4,600

Yesterday, April 9, the price of Bitcoin was in a bearish trend. The price fall was as a result of the $5,300 resistance level. The bulls could not make further progress as a result of this hurdle. The BTC price is now ranging below the $5,300 resistance level in an attempt to break the resistance level.

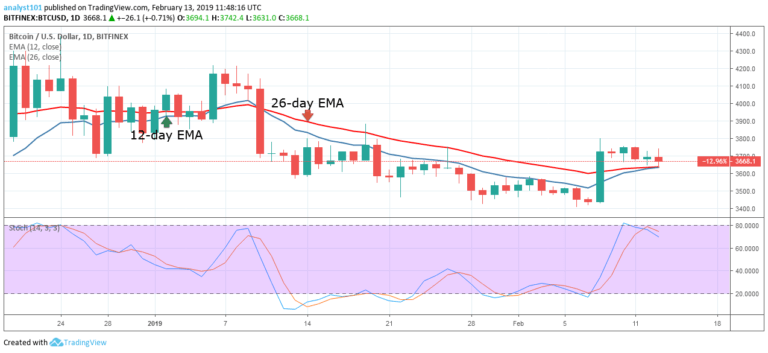

The crypto’s price is above the 12-day EMA and the 26-day EMA which indicates that the price is likely to rise. As long as the BTC price is trading above the EMAs, it is likely that the crypto’s price will overcome the $5,300 resistance level. Meanwhile, the stochastic indicator is at the overbought region but above the 80% range which indicates that the crypto is in a strong bullish momentum and a buy signal.

BTC/USD Short-term Trend: Bullish

On the 4-hour chart, the price of Bitcoin is in a bullish trend. Since April 8, the price of Bitcoin has been facing resistance at the $5,300 price level. From the 4-hour chart, a candlestick wick has tested the resistance level thrice before falling to the support of the 12-day EMA.

Each time the bulls were resisted, the price would fall to the support of the 12-day EMA. The BTC price is also trading in a tight range between the levels of $5,200 and $5,300. The bulls had been testing the $5,300 resistance level in the last three days.

Nevertheless, if the bulls fail to break the resistance level and the crypto’s price continues its range bound movement, a price breakout is imminent. A price breakout will see the crypto rally above the $6,000 price level. Meanwhile, the stochastic indicator is at the overbought region but above the 40% range which indicates that the crypto is in a bullish momentum and a buy signal.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.