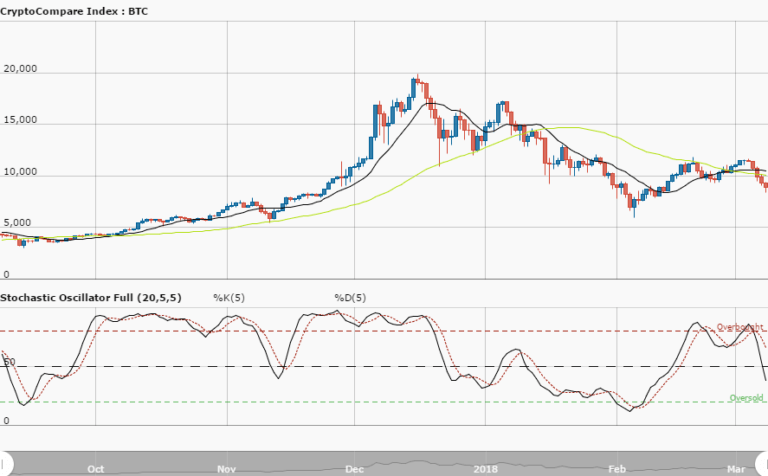

BTCUSD Long-term Trend – Ranging

- Distribution territories: $6,500, $7,000, $7,500

- Accumulation territories: $3,500, $3,000, $2,500

Bitcoin market valuation hasn’t been able to move strongly in the market as well as its counter currency i.e. the US dollar. Therefore, the cryptocurrency’s price value has continued to push around in range spots located at $5,500 and $5,000 marks.

Since April 17, the crypto-market has been making very weak moves a bit over the trend-line of the 14-day SMA closely towards the $5,500 upper range point. The 50-day SMA is situated near below $4,500 market point. The Stochastic Oscillators are found very close to range 60. And, they now consolidate around it to depict that the market is still much in a range trending-mote. The pair’s upper range point at $5,500 may be serving as the market rejection area which needs to be breached northwards out rightly to attest to the bulls’ movement in the market. On theother hand, a short fake spike could occur at that price point, and that could as well cause a notable fall downwards out of the range zones.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.