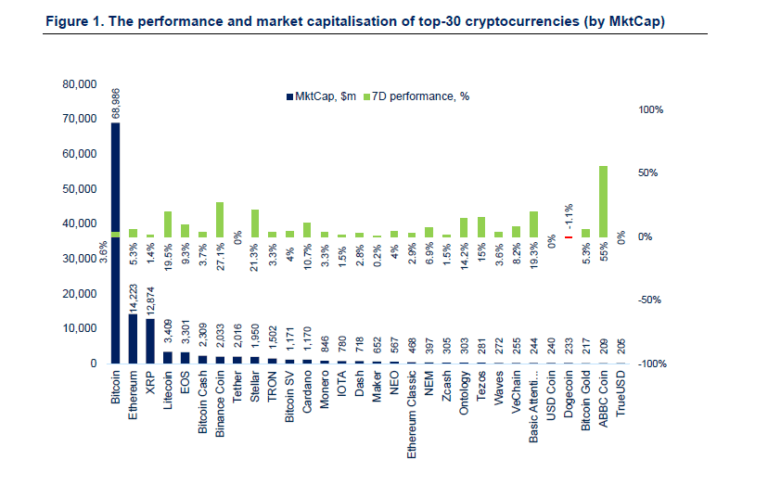

Digital assets recorded a positive week, where total the crypto market cap is up by 7% at $134bn. Top tier assets Litecoin (+19%), Binance Coin (+29%) and Stellar (+21%) have been showing zero short-term correlation with Bitcoin and are all up significantly, while the top three assets Bitcoin (+3.8%), Ether (+5%) and XRP (+1.5%) remain almost unchanged compared to last week. The past week’s performance of alt coins squeezed the gap of Bitcoin’s dominance by almost 2% to 51.6%. In terms of aggregated volume, last week saw a 24% spike from $125bn to $131bn.

Crypto Market News

BlockFI Announces Crypto Saving Accounts with 6% Annual Interest

New York-based crypto lending firm BlockFi will launch crypto saving accounts, with 6% annual interest, payable monthly in BTC or ETH. Funds will be backed by regulated and insured custodian Gemini. BlockFi aims in particular to attract investors from Japan, where the interest rate on savings is 0%.

SIX Swiss Exchange Launches Ether and Bitcoin Exchange-Traded Products

Switzerland’s largest stock exchange is launching bitcoin (ABTC) and ether (AETH) exchange-traded products (ETP) with a 2.5% management fee.

Argentinian Government Set to Invest in Crypto

The Ministry of Production and Labour has committed to co-invest in up to 10 Argentinian projects each year for four years. Every blockchain project which gets funding from Binance Labs can see an investment of up to $50k from the Argentinian government, according to a Binance blog post.

70% of UK Consumers Have Never Heard Of Crypto

The UK’s financial regulator FCA has surveyed more than 2,100 UK consumers in order to better understand awareness of crypto with the following results:

- 73% have never heard of cryptocurrencies or were unable to define what they are.

- Of the 27% able to define cryptocurrencies, the majority of them were men between the ages of 20-44.

- Of those that bought cryptocurrencies, 84% used online exchanges to acquire them.

- The most popular reasons for buying cryptocurrencies were as a gamble (31%), or as part of an investment portfolio (30%).

eToro Launches Crypto Exchange in 31 US States

Trading and brokerage firm eToro is launching its crypto trading services in 31 US states, where users can now use eToro’s crypto wallet services as well. The platform has already registered 10m users.

Starbucks Receives Equity in Bakkt Exchange

Coffee chain Starbucks has received an equity stake in cryptocurrency exchange Bakkt in return for allowing bitcoin payments in stores with more than 100m weekly customers.

Ernst & Young Introduces Tax Tool for Reporting Crypto

Big Four firm Ernst & Young has introduced a new product for claiming taxes on cryptocurrencies.

Chinese Miners are Expecting Cheap Power

Bitcoin miners in China are betting that abundant hydropower plants this summer will make crypto mining profitable again. Research firm Diar has also published a report, claiming signs of recovery following an 18-month low in mining revenue.

Swissquote Bank Launches Nuke Proof Crypto Custody

Online banking group Swissquote is launching a custody service which will see crypto keys stored in an ex-military bunker.

Last Week in Funding

Coinbase acquires Neutrino for $13.5m; Crypto broker Tagomi raised $12m in round led by Paradigm.

Security Token News

SIX Group to Tokenize Equity on R3 Blockchain

The operator of Swiss Stock Exchange SIX Group has selected private enterprise blockchain R3 for the digital asset trading, settlement, and custody service they are building. SIX chose R3 blockchain, after spending a good amount of time evaluating various DLT stacks, because R3 was designed for a highly regulated space, but also because of the wide ecosystem R3 is facilitating.

Circle Completes Acquisition of SeedInvest and Seeks $250m Raise

Goldman Sachs-backed crypto start-up Circle has closed its undisclosed acquisition of equity crowdfunding platform SeedInvest, after officially obtaining approval from FINRA. Circle, which previously raised $246m, is looking to raise another $250m via combination of equity and debt financing.

DX.exchange Adds Tokenized ETF

Nasdaq-powered digital trading platform DX.exchange has announced its addition of tokenised ETFs, including SPY(S&P 500) and QQQ(Nasdaq Composite) services. Tokenized ETFs are both fully compliant with ESMA and MIFID 2.

Regulatory News

Utah Introduces Bill That Would Exempt Blockchain Firms from Money Transmitting Act

The state of Utah has introduced a bill which would stop blockchain firms from being classed as money transmitters. The senate bill 213 also aims to create a task force to study the potential of the blockchain in government services.

SEC Commissioner Sees No Need for National Blockchain Policy

SEC Commissioner Hester Pierce has pushed back on the industry lobbyist Digital Chamber of Commerce’s coordinated national strategy for blockchain technology.

German Finance Ministry Calls for Regulated Digital Securities Market

In a recent paper, Germany’s Ministry of Finance has recommended that the country recognise digital securities as a legitimate form of financial instrument and regulate them as such. According to the agency, securities should be issued in electronic form and shouldn’t have to be documented on paper.

French Finance Committee President Calls for Ban on Private Crypto

Eric Woerth, president of France’s Finance Committee, would like to see a ban on privacy-oriented cryptocurrencies.

Malaysia Seeks Public Feedback on ICO Regulatory Framework

The Securities Commission Malaysia (SC), has issued two papers, seeking public feedback on the regulatory frameworks for ICO and property crowdfunding.