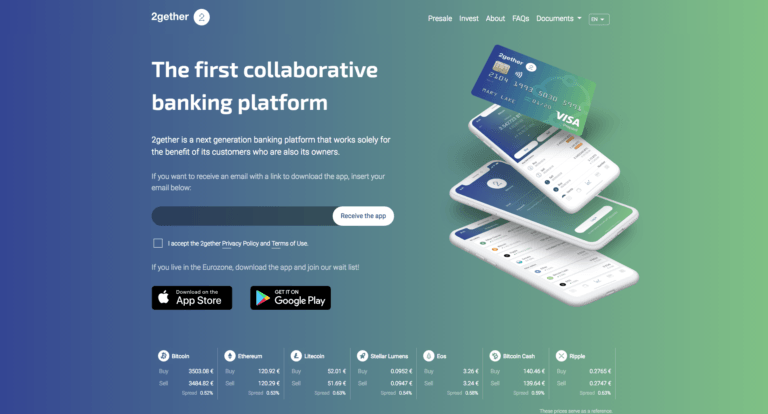

Spanish FinTech startup 2gether has announced a new Visa debit card that allow residents of 19 European Union (EU) countries to pay for goods/services using either fiat (euros) or crypto (XRP, BTC, ETH, BTC, BCH, EOS, XLM, and LTC) anywhere in the eurozone (i.e. those 19 EU countries that use the euro as their official currency) that accepts a Visa card.

Madrid-based 2gether was founded in 2016 and currently has around 30 people.

2gether says that its 2prepaid Visa debit card “allows consumers to spend crypto as easily as if they were euros anywhere, instantly without fees.” Here are a few examples:

“Whether it be shopping at your favorite boutique or taking a friend out for dinner, users simply swipe their 2gether card and it seamlessly integrates cryptocurrency into the everyday lives of its customers, essentially paying with crypto without even realizing it. Buying new shoes downtown? Swipe your 2gether card and your crypto seamlessly covers it all. Treating mom to brunch? Pay using your crypto with just a single swipe. Pay for parking at the theater, tickets to the premier, and even butter for the popcorn – all with crypto, as easily as swiping a Visa card.”

2gether customers can:

- “Pay in Euros or instantly convert 1 of 7 cryptocurrencies to pay with the Visa card: ETH, BTC, XPR, BCH, EOS, XLM, and LTC”

- “Hold and manage euro and crypto balances in the same app”

- “Buy and sell crypto in two clicks with no mark-ups to exchange prices”

2gether has already had a “beta launch” in Spain, but it soon plans to also launch in the other 18 eureozone countries (Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, and Slovenia); however, we currently do not have an exact launch date for these 18 countries.

Anyone who is resident in one of the 19 eurozone countries can download 2gether’s mobile app (which is available for both iOS and Android), go through the Know Your Customer (KYC) process, and then join the waiting list.

One thing that it is important to understand is that 2gether is not a bank, and it describes itself as “a financial platform that offers financial products and services manufactured and/or offered by third parties.” At the moment, its “money management services” are handled by “Pecunia Cards E.D.E., who hold an Electronic Money License authorized by the Bank of Spain.”

Pecunia Cards E.D.E is an Electronic Money Institution. Here is 2gether explaining how this is different from a bank and what this means for 2gether’s customers:

“Your money is managed by Pecunia Card E.D.E., an Electronic Money Institution regulated under the directive 2009/110 of the European Commission, and it is custodied by licensed banks with whom Pecunia has commercial arrangements. Unlike banks, Electronic Money Institutions cannot lend or invest the deposits of the customers and have to have them available at any time. Only the customer can order outflows or inflows of their capital.”

Although 2gether’s service is currently only for residents of the 19 eurozone countries, it does plan to expand to the rest of the world:

“At the moment, 2gether is being made available for residents of the 19 European countries which operate using the euro as their main currency. Our objective is to become a global platform and thus, we are working on expanding 2gether to the rest of the world as soon as possible.”

Ramón Ferraz, the CEO of 2gether, had this to say:

“2gether is developing the bank of the future, where consumers can take full ownership and control of the services they use and go beyond solely interacting with euros and dollars. To date, there has been no consumer-owned, tangible application that connects crypto and the mainstream market. We’re proud to be one of the first companies in the crypto space launching a token sale with an already finished product.”

Featured Image Courtesy of 2gether