ETHUSD Medium-term Trend: Ranging

- Resistance Levels: $230, $240, $250

- Support Levels: $130, $120, $110

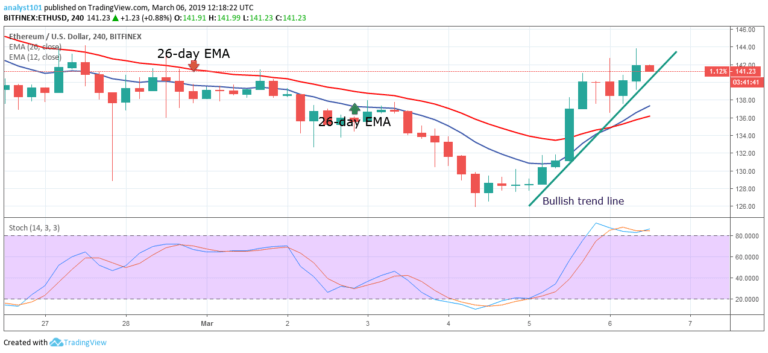

Yesterday, March 19, the price of Ethereum was in a range bound movement. On March 16, the bulls tested the $142 resistance level and were resisted. The bears broke the $140 support level and the 26-day EMA as the price fell to the low at $137.18. The bulls made a pullback above the 26-day EMA.

On March 18, the bulls made another attempt and tested the $140 resistance level and the price fell to the support of the 26-day EMA. The price fell to the low at $136.71 and commenced a range bound movement. On the upside, if the bulls break above the EMAs, the $140 resistance level may be tested or broken.

On the downside, if the bulls fail to break above the EMAs, the ETH price will fall and continue with its range bound movement. Meanwhile, the stochastic band is out of the oversold region but above the 20% range. This indicates that price is in a bullish momentum and a buy signal.

ETHUSD Short-term Trend: Bullish

On the 1-hour chart, the price of Ethereum is in a bullish trend. The price of Ethereum is trading at $137.86 as at the time of writing. The bullish trend line has been drawn to determine the duration of the bullish trend. The bulls are expected to break the $140 resistance level.

The bullish trend line is ongoing as long as the trend line is unbroken. If price breaks the trend line and another candlestick closes on the opposite side of it; the bullish trend is said to be terminated. If this happens before the $140 resistance level, then the resistance will remain unbroken.

The crypto’s price will resume its range bound movement. Nevertheless, the stochastic indicator is in the overbought region but above the 40% range which indicates that price is in a bullish momentum and a buy signal.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.