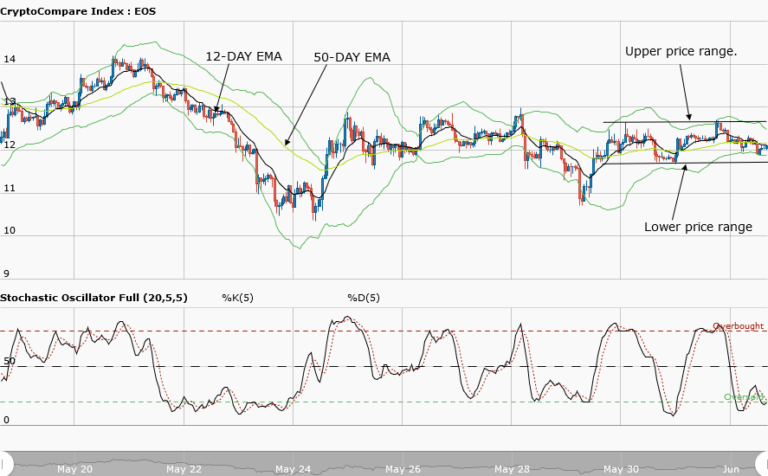

EOSUSD Price Medium-term Trend: Ranging

- Supply zones: $9.00, $10.00, $11.00

- Demand zones: $2.00, $1.00, $0.50

EOS remains in a range-bound market its medium-term outlook. The bears kept the pressure up and pushed the price down to $3.54 in the demand area before the loss in momentum yesterday. $3.71 was the high of the as the market before the end of yesterday’s session. Today’s 4-hours candle at $3.63 closed as inverted hammer an indication of sustained bear pressure.

The price is around the two EMAs with the stochastic oscillator signal in a parallel line at 46% an indication of possible bear pressure as EOSUSD is already down to $3.53 within the range.

EOSUSD is in consolidation and trading between $3.90 in the upper supply area and at $3.50 in the lower demand area of the range. Traders should wait for a breakout at the upper supply area or breakdown at the lower area with a retest before a position is taken.

EOSUSD Price Short-term Trend: Ranging

EOS is in consolidation in its short-term outlook. The bears’ pressure broke the lower demand area at $3.60 and returned the cryptocurrency back within the range. Rejection of the further downward movement was obvious as denoted by wicks.

$3.54 was the low before the bulls pushed price back into the range.

The price is within the two EMAs and the stochastic oscillator signal is parallel at 55% which is a reflection of the ranging scenario in the short-term

$3.74 in the supply area is the upper price range while $3.60 in the demand area is the lower price range. A breakout from the upper supply area or a breakdown from the lower demand area may occur hence patience is required for this to play out before taking a position.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.