On Tuesday (March 26), it was announced that Binance, the world’s largest crypto spot exchange by adjusted trading volume, had partnered with regulatory technology (RegTech) startup IdentityMind in order to “enhance compliance and data security measures.”

IdentityMind, which is backed by Medici Ventures, a wholly-owned subsidiary of Overstock.com, is headquartered in Palo Alto, California. It was launched in 2013 with the aim of “fighting financial crime.”

Its “digital identity” technology “uniquely identifies each individual in a frictionless manner and helps determine the risk that they pose to” a business. Its accuracy comes from “the ability to capture and assess a wide variety of attributes that help identify banked and unbanked alike” and due to advanced machine learning capabilities. This technology is delivered through a real-time web-based application programming interface. It “creates identity assets that can be anonymously shared (powerful encryption keeps the identity contents private) across customers, business units and companies, updating the identity and its associated risk with each interaction.”

IdentityMind’s platform “enables digital currency exchanges to comply with KYC and AML regulations worldwide”. IndentiyMind also claims that its “risk and compliance platform is the only real-time onboarding, transaction monitoring, and case management solution built for digital currency exchanges.”

According to IdentityMind’s press release, the purpose of this collaboration with Binance is “to improve existing data protection and compliance measures for Binance’s global operations.”

Samuel Lim, Chief Compliance Officer of Binance, stated:

“The partnership between Binance and IdentityMind further strengthens our compliance capabilities and our commitment to re-invest in the blockchain ecosystem and grow it. We continue to evolve and enhance security systems while adhering to regulatory mandates in the countries we operate in. The goal is to foster greater trust among financial institutions worldwide.”

Meanwhile, Garrett Gafke, President and CEO of IdentityMind, had this to say:

“With Binance’s tremendous trading volumes and its rapid expansion plans, compliance is naturally more challenging, especially in this fast-changing market. Our risk and compliance platform powered by a patented digital identities engine meet the scale demands of Binance’s global operations while providing a highly accurate system for assessing any global risk factors from outside entities for transactions. We are excited to provide the necessary tools that will allow them to continue growing and serving more users around the world in a secure and compliant manner.”

Forbes’ report about this partnership has an interesting quote from IdentityMind’s Director of Product Management, Neal Reiter:

“From a KYC perspective, Binance has a partnership with Refinitiv, which is a know-your-customer services provider company affiliated with Thomson Reuters. Binance also collaborates with Chainalysis, which is a blockchain explorer tool. However, IdentityMind provides digital identity, which is a combination of looking at a user’s physical and digital attributes. For instance, we look at a user’s physical address as well as their Bitcoin address, knowing that both of these won’t change simultaneously.”

He also added:

“There is a difference between security privacy and AML. Binance has privacy by design, so it’s extremely important that their customer’s data is both secure and private. We actually don’t see any information from Binance since they are sending encrypted data to the IdentityMind platform. I think it’s refreshing to see that Binance is trying to incorporate every service they can to provide for an extremely robust platform.”

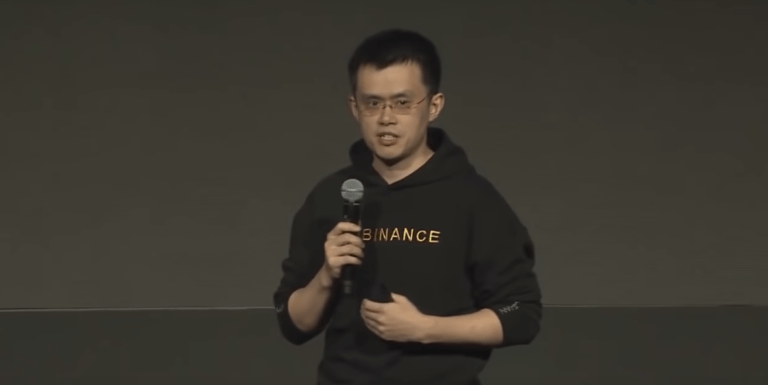

On the same that this partnership was announced, Changpeng Zhao (“CZ”), Co-Founder and CEO of Binance, took to Twitter to explain what the “secret sauce” to Binance’s wild success was:

Secret sauce of success. @binance is one of (being polite to others) the most self-regulated exchange in the world. https://t.co/VU6nIsZGwc

— CZ Binance (@cz_binance) March 26, 2019