Blockstream, a Canadian bitcoin (BTC) and blockchain-related development firm, has launched a new version of c-lightning, the company’s proprietary implementation of the Lightning Network (LN) protocol – which has become an increasingly popular layer-two payment solution for cryptocurrencies.

Written using the C programming language, the latest version (0.7) of Blockstream’s LN software is notably the company’ first major release in the past 8 months. The newly launched LN implementation reportedly features performance improvements, software bug fixes, additional privacy options, and more detailed documentation.

As mentioned in Blockstream’s official blog post, the new features were developed by a team of 50 different contributors from throughout the world. In total, the group of developers published 1,300 commits (additions to c-lightning’s codebase).

New Features For C-Lightning

The new features for c-lightning include:

- Plugins: “the flagship feature for the 0.7 release”. These “allow allow developers to extend Lightning with their own applications written in any language”,

- Routeboost: lets users “send and receive payments over non-public (private) channels by adding their details to invoices”,

- “Improved funds management”: “better control over which coins are used to fund channels”,

- Option_data_loss_protect: a function that allows for greater security against potential data losses

- “Reproducible builds”: lets developers build their “own Ubuntu binaries” which are a “collection of items [including] scripts, libraries, text files, a manifest, license”,

- “Better documentation”: “revamped … documentation which are now automatically generated at lightning.readthedocs.io”

As explained in Blockstream’s blog: “While extensibility and customizability, along with performance and security, have always been our primary goals, until now users had to write fully-fledged daemons in order to add simple functionality or make small changes.”

6,933 Lightning Network Nodes Have Been Launched

Daemons are software programs that run as a “background process” instead of “under the direct control of the interactive user” and are used to perform tasks related to the main programs or applications.

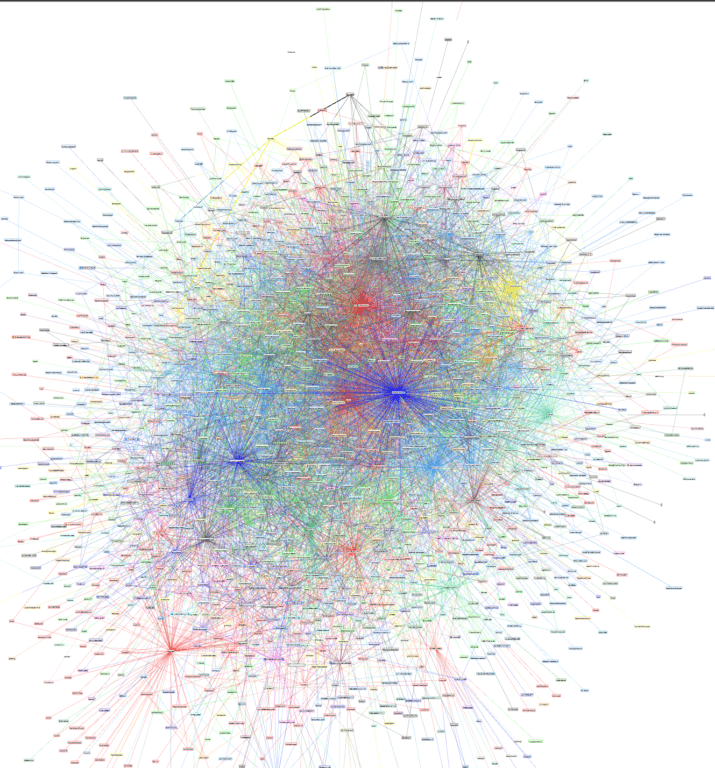

According to 1ML.com, a website that reports statistics for the LN, there are currently 6,933 LN nodes which is notably an 18.76% increase in the past 30 days. Total capacity for the LN has exceeded 700 BTC (appr. $2.83 million at current market prices), a 17% increase over a 30-day period.

As CryptoGlobe reported recently, Twitter co-founder and CEO Jack Dorsey shared screenshots of him using the $300 Bitcoin Lightning Network full-node he received from Casa, which is notably a sign of the billionaire entrepreneur’s growing commitment towards the layer-two crypto payment network and the flagship cryptocurrency.