As March comes to an end, Bitcoin (BTC) is set to put in its second consecutive green month, which follows a record-setting six months of monthly losses.

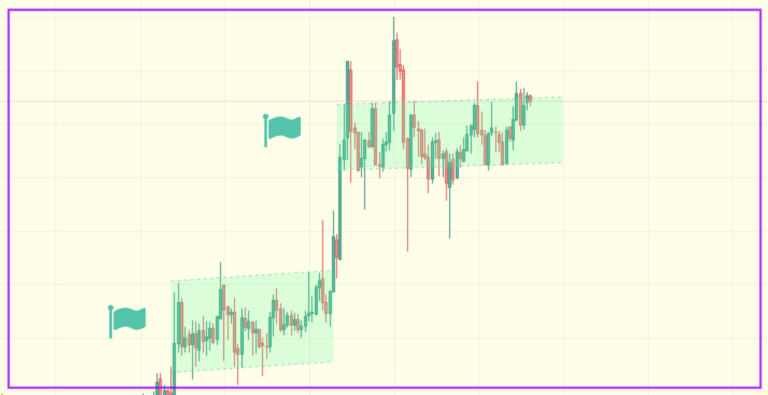

The leading crypto has in preceding days continued to show strength in what has already been an impressive uptrend, seeming to have formed another bull flag. This flag looks poised for another break up into the critical $4,100-200 support/resistance (S/R) range – if it can get the volume. A false breakout on March 30 quickly dumped and was re-bought up.

(source: TradingView.com)

(source: TradingView.com)

Bitcoin has for some time been trending in an upward channel, since February. This channel continued to be respected during the last push up – and we can expect the same respect should Bitcoin take another level up.

After several legs up within this channel, however, we should be accomodating the possibility of a breakdown or correction sometime soon to the bottom of the channel – to roughly $3,940.

(source: TradingView.com)

(source: TradingView.com)

A breakdown to the bottom of this channel, however, would not come as unduly negative. The extremely important 2018 linear downtrend resistance looks to be more or less broken-through, at this point. This accomplishment, if it sticks, should not be taken lightly, as this level has not been broken by Bitcoin price action for more than a year!

The real, and not inconceivable danger is of falling out of local uptrend channel altogether, correcting down to the regional uptrend. Again, doing this while staying above the 2018 downtrend would not necessarily be that bad – assuming that price was held by one of the S/R zones heading down, or by the regional uptrend itself. This would serve as a healthy correction and foundation-building for more 2019 gains.

Indeed, with Bitcoin approaching the $4.1-2k level, the market must soon choose whether or not the leading crypto will correct down, or make a massive breakout to the upside and definitively end the 2018 bear market trend. In all soberness, the former option is probably more likely.

(source: TradingView.com)

(source: TradingView.com)

Alternatively, if BTC could somehow preserve sideways ranging on low volatility, it might give altcoins even more runway to really explode – adding to already massive gains for some altcoins. Altcoins tend to do well versus Bitcoin when Bitcoin is calm, and when BTC dominance falls to 50% and under. The below chart shows Bitcoin dominance as a percentage.

(source: TradingView.com)

(source: TradingView.com)

All three options – breakout, breakdown, “alt season” – suggest that April will be an eventful month.

(The views and opinions expressed here do not reflect those of CryptoGlobe.com and do not constitute financial advice. Always do your own research)