The MVIS CryptoCompare Top 100 Index has raised 2.29% in the last 24 hours to 1,216.69

The MVIS CryptoCompare Top 100 Index has raised 2.29% in the last 24 hours to 1,216.69

Six coins from the top 10 coins by 24-hour volume posted negative changes, ranging from 0.90% to 2.57%. Billionaire Tim Draper: Only criminals will use fiat money, as cryptos will hit mainstream in next few years. Russian Minister: Cryptocurrencies need not be clearly defined under current regulations.

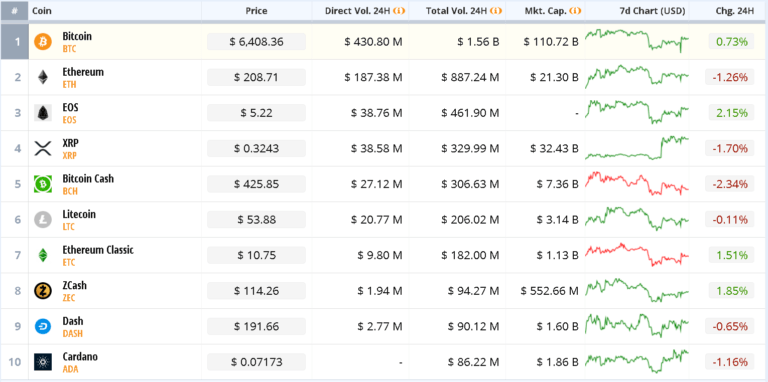

Top 10

Six coins from the top 10 coins by 24-hour volume posted negative changes, ranging from 0.90% to 2.57%. QTUM ($2.11) showed a loss of 2.31%, followed by Ethereum CLassic ($4.58) that posted a negative change of 2.14%. Bitcoin Cash ($142.67) represented a negative change of 1.78%. ZCash ($55.15) showed a loss of 1.04%, while Binance Coiin ($11.16) and Litecoin ($48.68) revealed gains of 14.70% and 2.42% respectively.

BTC

At the time of writing, the Bitcoin price is sitting at $3,943 representing a gain of 0.45% in the last 24 hours. More than 245 Mln worth of BTC were exchanged in the BTC/USD market representing a 14.10% share of the global daily volume. The BTC/USDT pair represents a 67.09% share.

ETH

The Ethereum price posted a negative change of 1.81% over the past 24 hours and is currently sitting at $145, with over $110 Mln worth of Ether exchanged in the past 24 hours on the ETH/USD pair, which has a 7.39% market share of the daily trading volume. The ETH/USDT pair represents a 47.61% share.

EOS

The EOS price is sitting at $3.8 representing a positive change of 4.11% in the last 24 hours. More than $35 Mln worth of EOS were exchanged in the EOS/USD market representing a 2.99% share of global daily volume. The EOS/ETH pair represents a 39.16% share.

XRP

The XRP price has dropped 3.96% over the past 24 hours and is currently sitting at $0.32, with more than $25 Mln worth of XRP exchanged in the past 24 hours on the XRP/USD pair, which has a 5.75% market share of the global daily trading volume. The biggest XRP pair is the XRP/USDT pair, that represents a 30.32% share.