On Tuesday (February 5th), Coinbase announced Bitcoin (BTC) support for its highly popular “user-custodied crypto wallet” app for iOS and Android.

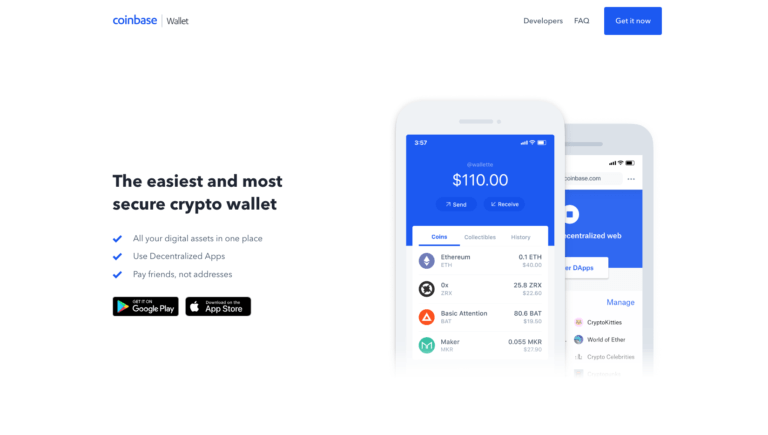

Coinbase.com (“Coinbase Consumer”) is “a digital currency brokerage.” It “can also act as a custodian, storing your digital currency for you after you purchase it.” In contrast, Coinbase Wallet is “a user-custodied digital currency wallet and DApp browser,” which means that “with Wallet, the private keys (that represent ownership of the cryptocurrency) are stored directly on your device and not with a centralized exchange like Coinbase Consumer.” A Coinbase Consumer account is not needed if you want to use Coinbase Wallet, and you can download it from anywhere.

Coinbase Wallet is a mobile app that initially only supported Ethereum (ETH) and Ethereum tokens (ERC20 and ERC721). On 26 November 2018, support for Ethereum Classic (ETC) was added. And starting today, it supports storing, sending, and receiving Bitcoin (BTC).

According to the blog post by Coinbase Wallet Product Lead Siddharth Coelho-Prabhu, this “new Wallet update with Bitcoin support will roll out to all users on iOS and Android over the next week.” He also says that “Coinbase Wallet supports both newer SegWit addresses with lower transaction fees, as well as Legacy addresses for backwards compatibility in all applications.”

Furthermore, Coinbase Wallet “also supports the Bitcoin Testnet to aid developers and power users.” As for support for other coins such as Bitcoin Cash (BCH) and Litecoin (LTC), Coinbase wants you to know that the Coinbase Wallet team is currently working on adding support for additional cryptocurrencies.

All Images Courtesy of Coinbase