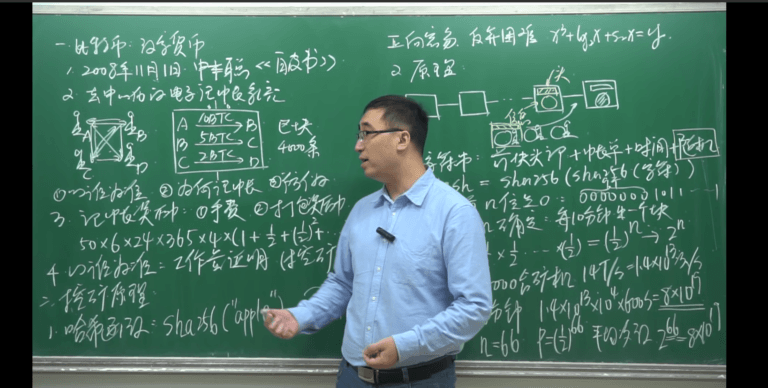

A Chinese internet celebrity called Li Yongle (李永乐) has recently made a 15-minute long video where he tried to explain to his followers what bitcoin and blockchain technology are. The video reportedly went viral in the country.

According to local news outlet 8BTC, Yongle has over 900,000 followers on a popular Chinese video-sharing platform, 2.8 million followers on the country’s version of Twitter, Weibo, and over 270,000 subscribers on YouTube.

This, as he is a well-known math and physics teacher in China, that helps others understand complex topics by simplifying them. The video of him explaining bitcoin and blockchain technology, which has also been shared on YouTube, is said to have been viewed over half a million times, and racked up over 5,000 comments.

This is the video of a Chinese internet celebrity introducing bitcoin and blockchain technology to his followers. According to @btcinchina it went viral.

On YouTube, it has over 250,000 views!https://t.co/TqldNRcSHo

— Francisco Memoria (@FranciscoMemor) February 21, 2019

The video went viral, according to 8BTC, thanks to key opinion leaders in the Chinese community, who helped spread the word by retweeting it. Among the 5,000 comments were viewers trying to learn more, asking how they can use bitcoin with their bank accounts, or whether or not mining the cryptocurrency consumes huge amounts of energy.

While the Chinese government has in the past cracked down on cryptocurrencies, state-run publications reportedly often share Li Yongle’s work. Other Chinese celebrities have reportedly already promoted bitcoin and cryptocurrencies on their shows.

Chinese cryptocurrency billionaire Zhao Dong has, back in November of 2018, predicted bitcoin could hit $50,000 within three years. Per his words, the right time to buy bitcoin is during the bear market, as those who “make truckloads of money do not have a very short-term speculative driven investment mindset.”

Notably, China’s central bank, the People’s Bank of China (PBoC), has late last year said security token offerings (STOs) are illegal in the country, reinforcing its attitude towards the nascent sector. Despite the central bank’s attitude, a Chinese court has ruled that cryptocurrencies like bitcoin should be protected by law.