Bitcoin’s automatically adjusting mining difficulty setting has resumed its late 2018 trend of decline, after a brief period of growth early in the new year. Mining difficulty on the Bitcoin network reflects hashrate, or mining power, which nearly halved between November and December 2018.

Historically, mining difficulty – and thus hashrate – is typically growing constantly on the Bitcoin network. Last year, a mining-versus-price analysis by Element Group calculated that difficulty was in decline for only about 13% of the network’s history.

2018’s bear year has resulted in unusual behavior in this regard, with now six out of 26 difficulty adjustments being downward, for 23% – far above the average.

For background, Bitcoin automatically adjusts mining difficulty approximately every two weeks. The difficulty setting seeks to adjust to the amount of hashrate on the network, in order to achieve a ten-minute block time.

(source: Bitinfocharts.com)

(source: Bitinfocharts.com)

(source: Bitinfocharts.com)

(source: Bitinfocharts.com)

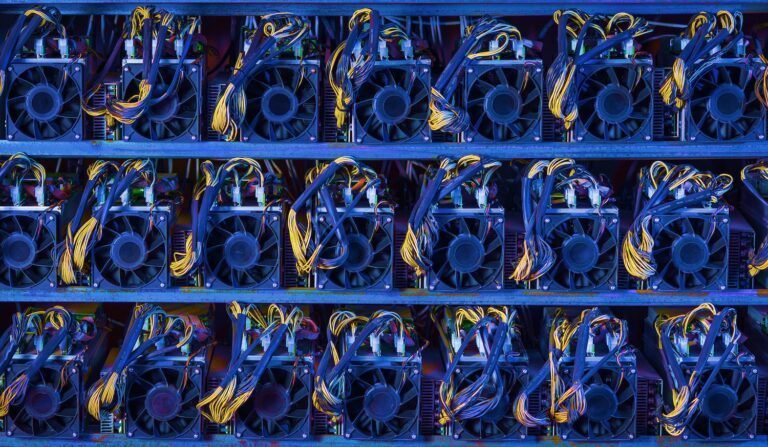

Declining difficulty necessarily reflects declining hashrate on the network, i.e. miners turning off their machines. The most likely explanation for declining hashrate is that mining has become unprofitable, and the most fragile and least efficient miners are unable to support their operations. Indeed, Bloomberg reported days ago that many miners are switching to Proof-of-Stake cryptoassets in order to get through the “crypto winter.”

(source: Bitinfocharts.com)

(source: Bitinfocharts.com)

Light at the End of the Mineshaft

CryptoGlobe reported last year on Element Group’s hashrate and difficulty analysis, which observed historical trends associated with declining mining difficulty.

The early November report wrote that (emphasis added) “Historical cycles suggest that we may need to experience 6 to 12 months of negative to flat difficulty growth for prices to bottom.”

If we take the start of declining difficulty from October generally, the Bitcoin network has seen nearly six months now of “negative to flat difficulty growth.” Many observers, including CryptoGlobe, have marked the 2018 – and now 2019 – declines as the longest bear market ever for cryptoasset markets.