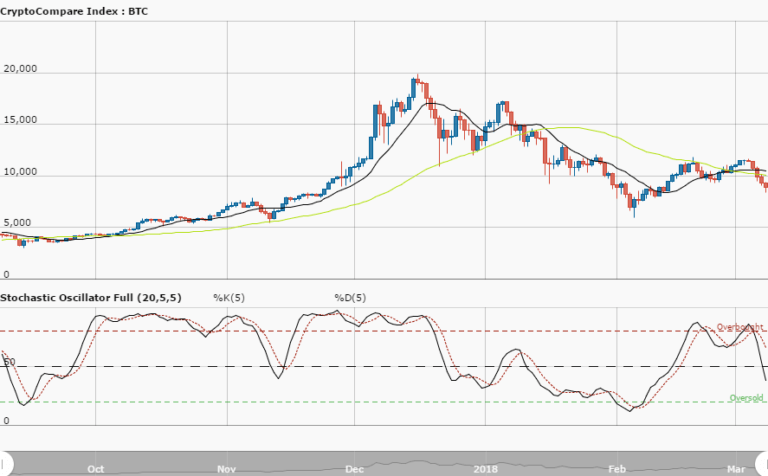

BTCUSD Long-term Trend – Ranging

- Distribution territories: $4,500, $5,000, $5,500

- Accumulation territories: $2,500, $2,000, $1,500

Bitcoin’s price has been ranging in the last few trading sessions. The cryptocurrency has essentially been seeing various lower lows and lower highs, around the $3,500 mark, since January 11.

The cryptocurrency’s 50-day SMA is currently above the 14-day SMA, while the Stochastic Oscillators have crossed from ranges 80 and 60 where they’re now consolidating. It’s currently unclear whether the bulls will be able to gather the momentum they need to help BTC’s price grow.

Currently, the bears are also seemingly unable to create a significant move on the market. Traders are to be on the lookout for a breakout above the 50-day SMA to enter a long position.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.