The government of Venezuela is reportedly planning to encourage its citizens to buy property using the controversial Petro cryptocurrency.

Ildemaro Villarroel, Venezuela’s minister for Habitat and Housing, told local news outlets that there was real estate currently available under the nation’s Great Housing Mission scheme. There is also a 10% discount being offered on all property that is purchased using the Petro, according to the Prensa Latina.

Since its launch, the Petro has been promoted primarily by Venezuela’s president, Nicolas Maduro. He has claimed that the national cryptocurrency is backed by the country’s vast oil reserves and that Venezuela will be able to use the digital asset to freely engage in trade relations with other nations.

Planning To Build 3 Million Housing Units By End Of 2019

Notably, there are currently 15 local construction companies that are prepared to conduct transactions using the state-backed digital currency. Commenting on the nation’s housing and real estate program, Villarroel said that the government was working with private companies to provide low cost housing and the initiative would also promote the use of Petro for acquiring property.

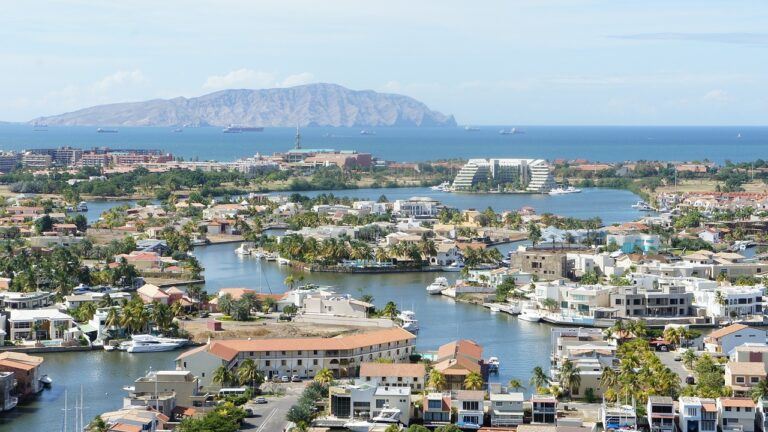

At present, there are 2,508,603 residential properties that have been built under Venezuela’s Great Housing Mission. The program’s goal is to build 3 million housing units by the end of this year. Introduced in 2011 by the former (late) Venezuelan president, Hugo Chávez, the housing program aims to help local residents that were affected by the severe flooding which took place during 2010-2011.

Although the housing fund is available to all Venezuelan citizens who may have been displaced or lost their homes, it is mainly intended for people that may not be able to afford buying property due to crippling hyperinflation.

Venezuela Fights Back Against International Sanctions

As CryptoGlobe reported last week, the Venezuelan government had filed a complaint against the US before the World Trade Organization (WTO). The South American country’s government has accused the US of violating the General Agreement on Tariffs and Trade (GATT) and the General Agreement on Trade in Services (GATS).

The accusations have been made in response to the renewal of US government-led political and economic sanctions enforced on Venezuela. As stated in the complaint document, the US has imposed (what Venezuela’s government considers) “discriminatory coercive trade-restrictive measures with respect to transactions in Venezuelan digital currency”.

As covered, Reuters had performed a four-month long investigation last year in Venezuela which was focused on determining whether the Petro was actually being used for local or global transactions. Notably, the reporting agency found “no evidence” of the so-called national cryptocurrency being used by Venezuela’s citizens or businesses.