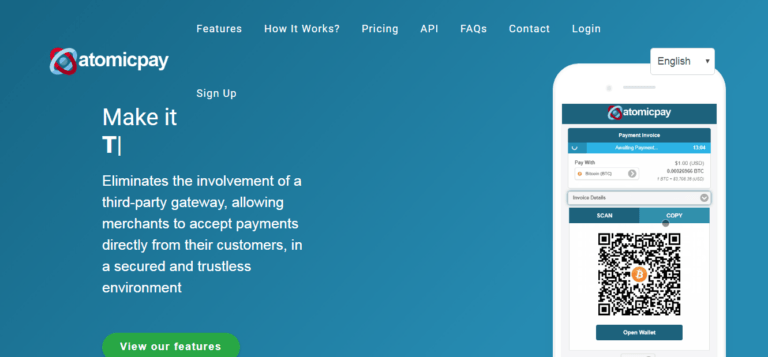

Atomicpay, a Thailand-based payments solutions provider, has reportedly introduced a non-custodial digital currency payment terminal.

Accessible to merchants globally, the new crypto payment terminal’s development was led by its founder Benz Rif. According to Rif, the platform will initially support payments in bitcoin (BTC), bitcoin cash (BCH), litecoin (LTC), and a few other major cryptocurrencies. Similar to how other crypto payment processing solutions are designed, Atomicpay’s platform aims to eliminate the need for third-parties to settle transactions.

Crypto Services Should Be Decentralized

During an interview with Bitcoin.com, Rif stated:

Cryptocurrency itself is decentralized, but blockchain payment processors continue to be centralized. This resulted in the same old problems with high processing fees, hidden charges, slow settlements, hacks, foul play, privacy and censorship issues.

In order to improve the process of transferring digital currency payments, Atomicpay allows merchants to obtain immediate custody of their funds. Unlike Bitpay or Paypal, Atomicpay’s crypto payments network never holds funds on behalf of their clients. As explained by Rif, the Atomicpay platform is “entirely” a peer-to-peer (P2P) payments solution.

Not A Comprehensive Solution

Those looking for a comprehensive cryptocurrency payments solution might have to explore other options as Atomicpay does not provide a wallet service. Atomicpay’s digital currency payment processor only focuses on making it easier to make payments, as it does not offer an exchange service like many other platforms such as Waves.

Notably, Atomicpay’s crypto platform allows users to convert their cryptocurrencyes into 156 different fiat currencies. Users have to scan a QR code, or provide their crypto wallet address, in order to make payments to merchants.

Rif revealed that over 1,700 merchants from countries such as Venezuela, Turkey, Thailand, and Colombia were planning to use Atomicpay’s crypto payment processing services. The Thailand-registered payment processor charges 0.9% per transaction from customers that haven’t completed know-your-customer (KYC) checks and 0.8% from those that have submitted identity verification documents.

Non-custodial payment solution. You have immediate ownership of funds whenever a customer pays you! Here is a short deck on AtomicPay. https://t.co/Gxs2EPbS5i#CryptoInfluencers #cryptocurrencies #cryptonews #cryptocurrencynews #blockchain #bitcoin #bch #btc #ltc #dash #btx #grs

— AtomicPay.io 🌐 (@AtomicPay) January 6, 2019

As explained by Riff, Atomicpay uses a “post-paid charging model” in which its users have to pay usage fees at the end of each month. Clarifying how payments are handled, Riff noted that Atomicpay does not have access to users’ private keys at any point while processing transactions.

As CryptoGlobe reported in late November 2018, Bitpay, the leading fiat-to-cryptocurrency gateways, has alerted its customers that the code used by its Android wallet app might have been vulnerable to an exploit, allowing hackers to steal users’ private keys. However, Bitpay’s developers had also released patch after learning about the security issue.