SBI Group, a Tokyo-based financial services firm that launched (last year) the first bank-owned digital currency exchange in Japan, has invested $15 million in Tangem, a Switzerland-based developer of “smart physical banknotes” for cryptocurrencies.

“Smart Physical Banknotes”

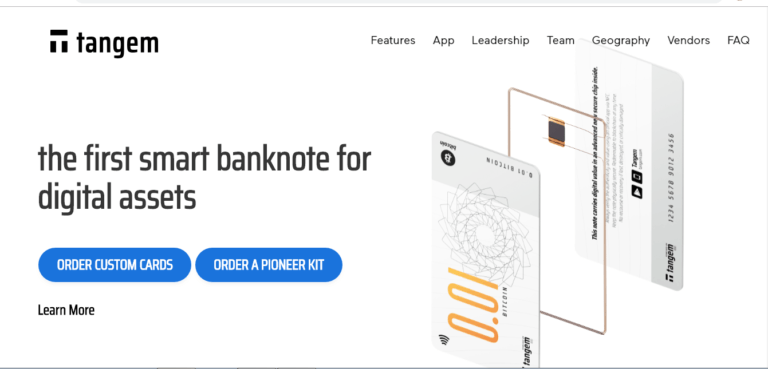

As explained on Tangem’s official website, the company has designed proprietary slimline hardware wallets for digital assets – which it refers to as “smart banknotes.” In addition to providing a cold storage solution for cryptoassets, Tangem’s banknotes may be used like a bank-issued debit card. The product’s users may settle transactions off-chain after depositing cryptocurrency onto the device through an NFC-enabled mobile phone.

On Monday (January 21st), Tanzem’s management team announced that it would be working with the SBI Group to introduce other financial products including stablecoins, digital identity solutions, and platforms for conducting tokenized asset offerings, and initial coin offerings (ICOs).

Investing In Tangem Because It Provides “Robust” & “Inexpensive” Hardware Wallet

Confirming the partnership in a separate announcement, the SBI Group said the initiative was being financed and managed through the firm’s SBI Crypto Investment division. SBI Group’s management explained they had invested in Tangem because it offered a “robust” crypto wallet product which was also “inexpensive.”

Commenting on the collaborative effort, Yoshitaka Kitao, the president and CEO of SBI Holdings, remarked:

The Tangem hardware wallet, which is highly secure and affordable, is an important tool to promote mass adoption of digital assets and blockchain. We believe utilizing Tangem will help stimulate the demand for other blockchain services provided by SBI.

On October 22nd, 2018, the SBI Group announced its partnership with Sepior, which also involves the development of a digital asset wallet for SBI Holdings’ digital currency exchange, VCTRADE. In March of last year, the SBI Group had acquired a 40% stake in Taiwan-based cold storage wallet manufacturer, CoolBitX.

Huge Losses Due To Cryptocurrency Hacks

During the first half of 2018, Japanese investors reportedly lost over $500 million due to hacks of various local digital currency exchanges. This, according to the country’s National Police Agency (NPA) which may not have accounted for the Coincheck hack in late January 2018. Notably, the security breach involving Coincheck last year had resulted in the loss of over $534 million worth of NEM (XEM) tokens.

Due to the relatively high risk of keeping digital currencies on centralized exchanges that usually have access to users’ private keys, an increasing number of crypto investors have started using hardware wallets to store their digital assets.

As CryptoGlobe reported in October 2018, Eric Larcheveque, the CEO of Ledger, a leading crypto hardware wallet provider, had said that every investor must store their cryptoassets on a hardware wallet. He also wrote in a blog post:

When you own cryptocurrencies, what you really own is a 'private key', a critical piece of information used to authorize outgoing transactions on the blockchain network. Whoever has the knowledge of this key can spend the associated funds. Hence the famous expression 'not your (private) keys, not your bitcoins'.