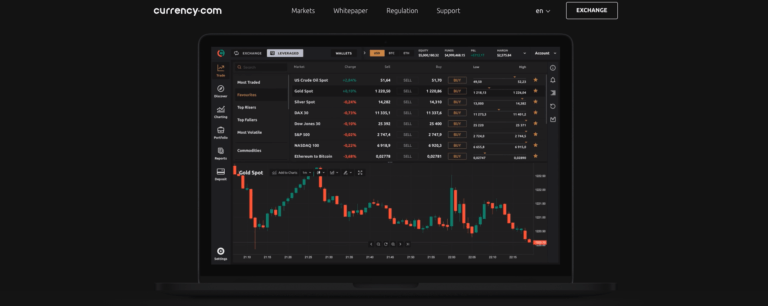

On Tuesday (January 15th), Belarus-based blockchain startup Currency.com announced the launch of a new tokenized securities trading platform that lets traders/investors buy tokenized commodities (such as spot gold and silver), market indices (such as NASDAQ 100 or DAX 30), and (German or U.S.) stocks (such as Apple, eBay, and GoPro) directly using cryptocurrencies (Bitcoin or Ether) without the need to convert first from crypto to fiat.

Currency.com is “accessible to all types of investors”, and currently offers over 150 tokenized securities, with plans for this number to eventually exceed 10,000. These tokens “will track the underlying market price of common financial instruments, such as global equities, indices and commodities.” The new exchange’s press release says that “Currency.com leverages the technology of Capital.com, its sister platform regulated by the FCA and CySEC.”

But wait — there’s more:

“The tokenised securities trading platform will be supplemented by a free platform for trading and exchanging cryptocurrencies using fiat money, storing holdings in a secure place and making cross-crypto exchanges; as well as Moonfolio, a free all-in-one cryptocurrency portfolio tracking app which allows users to build a diversified cryptocurrency portfolio from scratch.”

Currency.com plans to authorize “new users on the platform gradually to ensure optimal functionality as the service scales.” You cna apply to get on the waiting list at the Currency.com website. There will also be “a referral program through its traders who will receive invitation codes that they can share with friends.”

Currency.com also says that it is “the first blockchain business to be licensed by the High Technology Park (HTP) in Belarus following the adoption of the Decree No. 8 ‘On the Development of a Digital Economy’,” which “legalizes businesses based on blockchain, providing a legal status for tokens and smart contracts and legalizing operations related to mining, keeping, buying, selling, distributing, or exchanging cryptocurrencies, such as exchange services, digital tokens, initial coin offerings and mining operations.”

Ivan Gowan, CEO at Capital.com and Co-Founder and CEO at Currency.com, had this to say:

“We are excited to be launching this revolutionary blockchain venture and providing crypto investors with a concrete option to diversify their portfolio by investing in traditional asset classes, without the pressure of exchanging cryptocurrencies into fiat money to do so. Currency.com is committed to providing users with superior security and fraud protection, and preventing any potential risks by leveraging the full traceability of blockchain transactions and adhering to the strictest regulatory standards set by Belarus’ Decree No. 8 ‘On the Development of a Digital Economy.”

Currency.com’s mobile app (for iOS and Android apps) should be available for beta testing next month.

It is important to note that although Currency.com claims to be offering the “World’s First Tokenised Securities Trading Platform,” another European cryptocurrency, DX.Exchange, which launched on January 7th, also lets you trade tokenized U.S. stocks (such as Apple and Tesla), although the latter currently only offers support for 10 Nasdaq stocks and not any indices or commodities.

Featured Image Courtesy of Currency.com