EOSUSD Price Medium-term Trend: Bullish

- Supply zones: $9.00, $10.00, $11.00

- Demand zones: $2.00, $1.00, $0.50

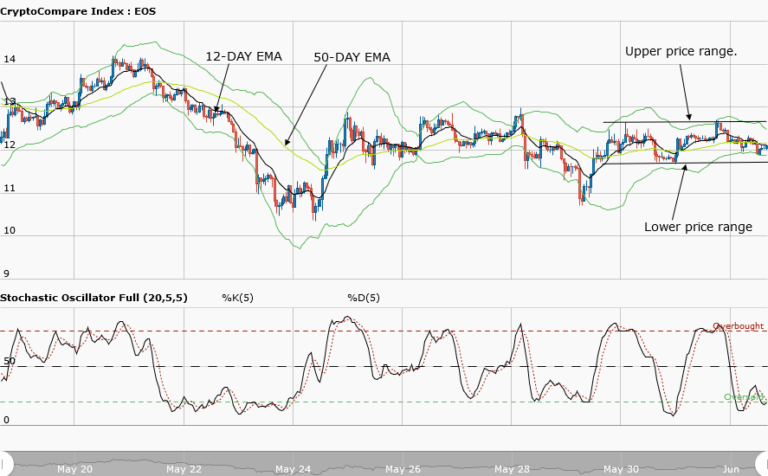

EOS remains in a bullish trend in its medium-term outlook. The bearish pressure from the doji and yesterday’s opening session was lost at the 50.0 fib area which was at $2.67 in the demand area. This was around the 50-EMA.

The bulls gradually returned before the end of yesterday session and pushed EOSUSD up at $2.76 in the supply area increased momentum the crypto at $2.85 in the supply area which was at the 23.6 fib area.

With the price above the 50-EMA and the stochastic oscillator at 28%, the bulls still remain in control. A retest and subsequent breakout at $3.00 in the supply area in the medium-term is probable.

EOSUSD Price Short-term Trend: Bullish

EOS remains in a bullish trend in its short-term outlook. The bulls resumed the upward price movement yesterday after each touch at the key demand area around the $2.70. EOSUSD was up at $2.85 in the supply area before a drop to the key demand area as a result of the bearish pressure.

The bulls are gradually staging a comeback at the key demand area for a bounce to the upside.

The stochastic oscillator is in the oversold region at 13% and its signal pointing up an indication of upward momentum in the cryptocurrency price in the short-term.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.