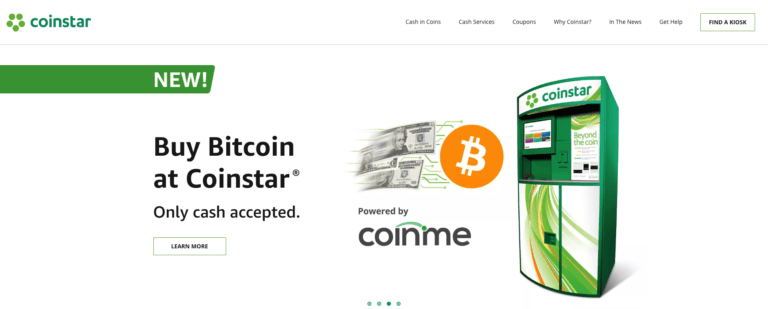

On Thursday (January 17th), Coinme, America’s first licensed Bitcoin ATM operator, and Coinstar, which owns and operates around 20,000 fully-automated self-service coin-counting kiosks in nine countries, announced that they had entered into a partnership that will make it possible for Coinstar kiosks, which are mostly located in U.S. grocery stores and supermarkets, to sell Bitcoin (BTC) in exchange for cash (USD).

According to the Frequently Asked Questions (FAQ) page on the Coinme website, Bitcoin can be purchased “at participating retailers that have Coinstar kiosks enabled for the Coinme product.” Only paper money (and not coins) can be used to buy Bitcoin from these kiosks. Currently, hundreds of kiosks in eleven U.S. states—Arizona, California, Colorado, Illinois, Indiana, Kansas, Louisiana, New Mexico, Texas, Utah, and Washington—seem to be offering this new service, but the two companies hope that soon thousands of Coinstar kiosks will become Bitcoin-enabled. You can find Coinme’s kiosk finder to find the kiosks closest to a specified cite, state, or zip code.

Per the press release, here are the steps to buying Bitcoin from a Coinme-powered Coinstar kiosk:

- “Go to a select Coinstar kiosk, touch “Buy Bitcoin,” review and accept the transaction terms, and enter your phone number.”

- “Insert U.S. paper money into the cash acceptor (any amount up to $2,500).”

- “Receive a voucher with a Bitcoin redemption code.”

- “Visit www.coinme.com/redeem to create a Coinme account or sign in to your existing account to claim your Bitcoin.”

Here are a few important things you should know about this new way of buying Bitcoin:

- “There is a 4% fee to use this service.”

- “The Coinstar kiosk cannot give change back, so you must load the exact amount to buy your Bitcoin.”

- The maximum amount of Bitcoin you can purchase per 24-hour period is $2,500.

- “Once you initiate redemption by entering your provided redemption code and completing the KYC process, your Bitcoin transaction will be broadcast to your Coinme wallet. Typically, Bitcoin transactions take between 10-30 minutes to confirm and become available to use.”

Neil Bergquist, Coinme Co-Founder and CEO, had this to say:

“We’re excited to team up with Coinstar to give consumers a convenient and easy way to buy Bitcoin during the course of their daily routines. Bitcoin is now accessible at your local grocery store via Coinstar kiosks, and this offering will make it even easier for consumers to participate in this dynamic new economy.”

And Jim Gaherity, the CEO of Coinstar, offered this comment:

“Coinstar is always looking for new ways to offer value to our consumers when they visit our kiosks, and Coinme’s innovative delivery mechanism along with Coinstar’s flexible platform makes it possible for consumers to easily purchase Bitcoin with cash.”

Featured Image Courtesy of Coinstar