ADA/USD Long-term Trend – Ranging

- Supply zone: $0.0600, $0.0800, $0.1000

- Demand zone: $0.0100, $0.0080, $0.0060

ADA continues in a range-bound market in its long-term outlook. The large bearish engulfing candle at $0.053001 returned the Cardano price back to the range as price dropped initially to $0.04291 on 10th January. The bearish pressure continued within the range with a further drop to $0.05477 in the demand area on 14th January.

The formation of a bullish railroad is an indication that the bulls are gradually staging a comeback within the range as yesterday session ended with price up at $0.04578 in the supply area.

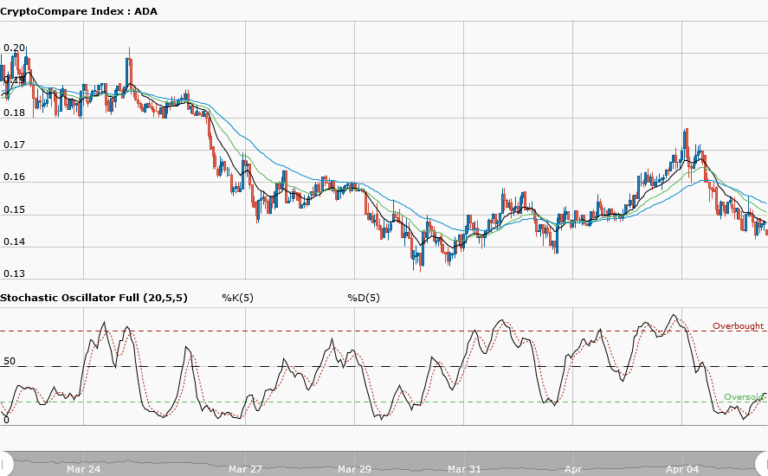

Price is below the two EMA crossover with the stochastic oscillator signal is parallel and its signal is in parallel line an indication of the ranging scenario.

ADAUSD is consolidation and trading between $0.05200 in the upper supply area and at $0.03300 in the lower demand area of the range. A breakout at the upper supply area may be considered for a long position after a retest while a breakdown at the lower demand area may be a short position with good candle pattern as confirmation for entries. Hence patience is needed to allow this occurred before taking any position as the range remains intact.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.