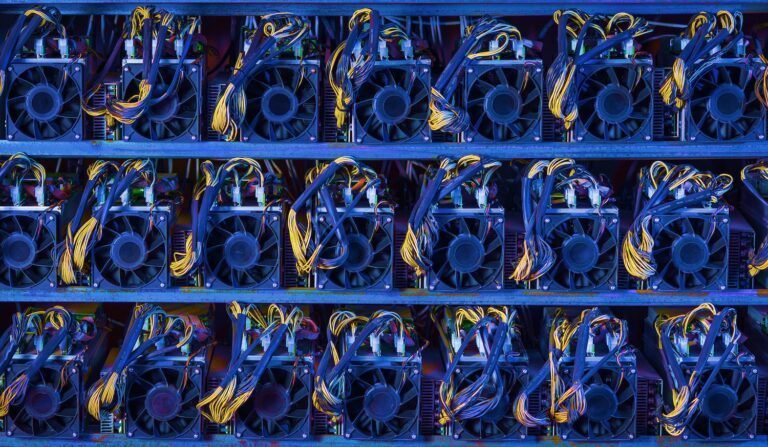

Canaan Creative, a producer of application-specific integrated-circuit cryptocurrency miners (ASICs) and competitor to Bitmain, is considering conducting an Initial Public Offering (IPO) in the US after its IPO application to the Hong Kong Stock Exchange (HKEX) lapsed and was therefore rejected by default. Bloomberg reported the news today citing insider sources.

The China-based ASIC firm is in talks to “[sell] shares in New York as soon as [H1],” according to Bloomberg. Canaan had hoped to be trading on the HKEX by July 2018, after filing in May.

CryptoGlobe reported in November that Canaan’s IPO application in Hong Kong had expired to no result, despite backing from big names such as Morgan Stanley, Deutsche Bank AG and Credit Suisse Group. The firm had to continuously adjust its raising targets down, first from $2 billion to 1$ billion, then to $400,000.

An anonymous source, cited by CoinDesk, claimed that the HKEX was tepid on crypto-related businesses because of the industry’s youth and volatility, and that this coolness was causing delays in application approval. The source added that “The HKEX doesn’t want to be the first exchange in the world to approve [an ASIC producer] and have [it] die on them”

The three largest ASIC producers – Bitmain, Canaan and Ebang – had all filled for IPOs in Hong Kong during 2018. Bitmain’s and Ebang’s prospects for approval are not much better.

Success in the US?

The South China Morning Post (SCMP) recently reported that the HKEX, briefly an attractive IPO destination for Chinese tech firms after a 2018 reform of its listing rules, is rapidly waning in popularity in favor of US listing.

This is apparently due to the poor market performance of tech companies listed in Hong Kong, below expectations. Analysts cited by the SCMP claim that the US has a “a deeper investor base for technology companies,” and that IPOs there could be smaller and still succeed.

Canaan reported $191 million of revenue in 2017, according to its HKEX filing – far dwarfed by Bitmain’s $2.5 billion revenue during the same period.