Opera has recently rolled out its built-in cryptocurrency wallet to its Android browser’s stable version, meaning all of its users on Android devices will be able to easily set up their wallets through the application, and access the decentralized web (known as Web 3.0).

According to The Next Web, the move was announced at the Hard fork Decentralized event in London, where the company revealed it’s now the first mainstream browser to add cryptocurrency and blockchain-based features.

Building a Browser-Based Wallet

As CryptoGlobe covered, Opera announced it was developing a mobile browser for Android with a built-in crypto wallet back in July of this year. Initially, the feature was only available for beta testers as the company kept upgrading it to not just support ETH and ERC-20 tokens, but also ERC-721 crypto-collectibles.

In August, it added the built-in cryptocurrency wallet to its desktop browser, while keeping it available only for testers. Currently, Opera’s wallets only supports the ETH network, as it “has the largest community of developers building Dapps and has gathered a lot of momentum behind it,” according to project lead Charles Hamel.

Opera reportedly decided to add the cryptocurrency wallet to its browsers in a bid to stimulate the mainstream adoption of cryptocurrencies. The firm’s executive VP Krystian Kolondra was quoted as saying:

Our hope is that this step will accelerate the transition of cryptocurrencies from speculation and investment to being used for actual payments and transactions in our users’ daily lives.

In the future, the browser’s wallet may support other cryptocurrencies, but the company clarified it isn’t yet ready to commit to an announcement. Currently, Opera’s focus is on making it as easy as possible for users to interact with decentralized applications (dApps) on the Ethereum network, while stimulating their growth.

Per Hamel, before Opera’s wallet was launched users needed “a special browser or special browser extensions to even start exploring the decentralized web,” and were later on faced with terminology that could be confusing.

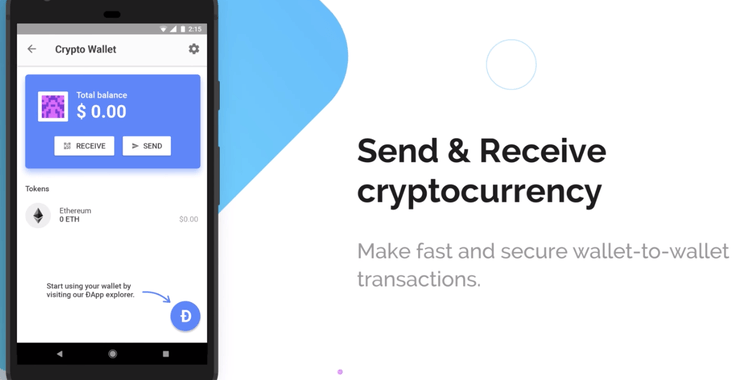

Opera’s Built-in Crypto wallet

According to The Next Web’s report, the company’s team had to “learn a lot of new technology” and to build competencies around blockchain technology and cryptography to build its crypto wallet.

Per Hamel’s words, one of the biggest challenges it faced involved defining what a browser wallet should look like. On-site compatibility also saw the team struggle, as Web 3 is currently seeing a phenomenon similar to what happened in the early days of the web, where developers “made different assumptions in their code,” making it behave differently in different browsers.

Currently, developers are also showing signs of progress when it comes to this phenomenon. Hamel added that when it comes to security, Opera took every measure to ensure its users’ safety:

Security has been a focus for the team since the inception of this product- We decided early-on to use Android’s secure key storage (with hardware support) and protect the keys to the wallet using the user’s device lock screen.

Per the project lead, this both helps users avoid having to create a new PIN code to remember, and guarantees the “maximum security possible offered by the Android OS.” Near the end of the report, he revealed he believes every web browser will “eventually integrate some kind of [crypto] wallet,” enabling new business models to emerge.

Ethereum co-founder Joseph Lubin, the CEO of ConsenSys, also pitched in. Lubin noted this was an important moment to improve dApp accessibility, and to open Web 3 to mainstream audiences.

Opera’s browser with a built-in crypto wallet is currently available on Google Play. The company itself, across all platforms, is said to have well over 300 million users, while the browser itself has over 100 million downloads on the Android app store.