On Monday (3 December 2018), Joseph Christinat, Vice President of Communications at Nasdaq, confirmed that the second-largest exchange in the world (by market cap) will definitely be launching a Bitcoin futures product in the first half of 2019.

We first head about Nasdaq’s upcoming Bitcoin futures last week during the “Consensus: Invest 2018” conference in New York City. Here is a tweet by Gabor Gurbacs, Director of Digital Assets Strategy at VanEck/MVIS, which was sent on November 27th:

@Nasdaq and VanEck’s @MVISIndices announces #index #partnership and intention to bring to market transparent, regulated and surveilled #DigitalAssets products, such as #Bitcoin futures contracts. More info to come. Share & follow us. #crypto #futures #SMARTS #ConsensusInvest pic.twitter.com/Q2oCZx4pp1

— Gabor Gurbacs (@gaborgurbacs) November 27, 2018

However, it was not until yesterday that we got confirmation from someone at Nasdaq that this was indeed going to happen.

According to an article in UK newspaper Daily Express, a Nasdaq VP, Joseph Christinat, has said:

“Bitcoin Futures will be listed and it should launch in the first half of next year – we’re just waiting for the go ahead from the CFTC but there’s been enough work put into this to make that academic. “We’ve seen plenty of speculation and rumours about what we might be doing, but no one has thought to come to us and ask if we can confirm it, so, here you go – we’re doing this, and it’s happening.”

Christinat also added that the worsening bearish sentiment in the crypto market is not going to deter Nasdaq from launching Bitcoin futures contracts in H1 2019:

“We got into the blockchain game five years ago, and when the technology first popped up we just leant out of the window and shouted ‘hey come over here’ right at it. We’ve put a hell of a lot of money and energy into delivering the ability to do this and we’ve been all over it for a long time – way before the market went into turmoil, and that will not affect the timing of this in any way. No. Period. We’re doing this no matter what.”

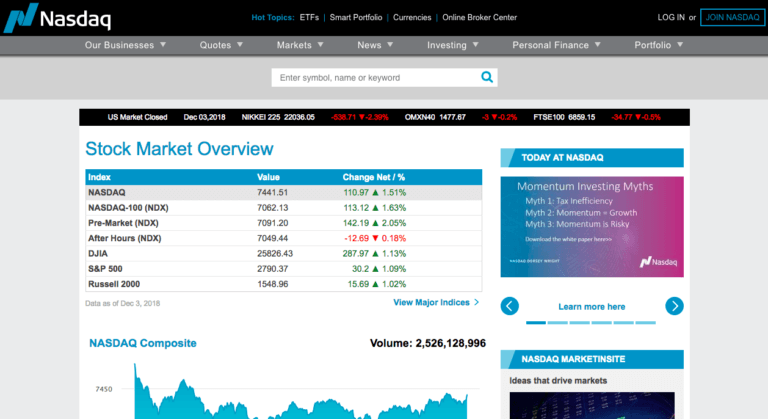

Featured Image Courtesy of Nasdaq