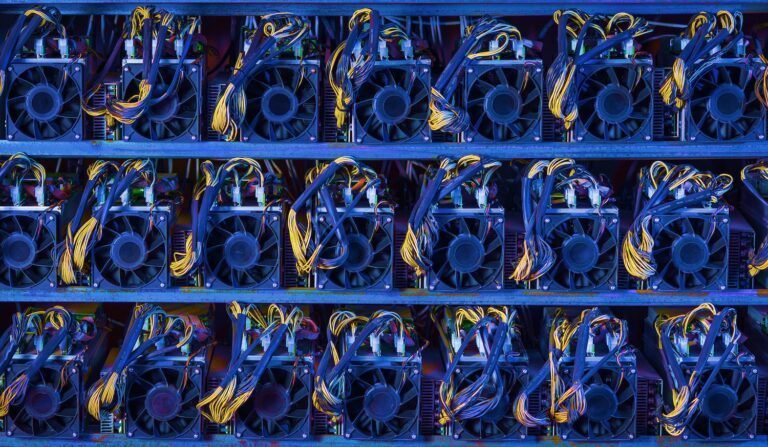

The Honk Kong Stock Exchange (HKEX) are stalling the public listing of three large cryptocurrency hardware mining manufacturers, Coindesk have reported today citing an inside source. The three producers in question are Bitmain – the dominant producer of application-specific integrated circuit miners, or ASICs – and its smaller competitors Canaan Creative and Ebang International Holdings.

Both the HKEX and the Hong Kong Securities and Futures Commission (SFC) must sign off on an IPO before a final approval hearing is conducted – but none of the mining companies is even close to a final hearing, and at least one’s application (Canaan) has already expired the six-month request period.

Why?

According to the unnamed source, who is “involved in the talks” at the HKEX concerning the respective ASIC producers, the volatility of the cryptoasset industry in general is a cause for concern among decision makers at the exchange. The source said that, “The HKEX doesn’t want to be the first exchange in the world to approve this and have one die on them.”

Neither Bitmain nor Ebang have yet released Q3 earnings report – even in Bitmain’s case, having finally released a long-researched new product line. According to CoinDesk’s source, these admissions would be required by the HKEX and SFC in order to let applications proceed.

A Bad Year for Bitmain

Bitmain in particular have had a lamentable turn of fortune during 2018, after climbing last year to dominate the cryptocurrency ASIC mining scene. The Beijing-based company’s health has mirrored the industry’s total valuation, which began falling precipitously in February.

When the company released its year-to-date earning reports upon filling for the IPO, it was widely accused of framing the numbers in such a way as to mask significant losses. CoinDesk later claimed on the basis of private sources that Bitmain had falsified pitch decks to potential investors in its IPO, opening it up to potential legal action from Hong Kong law enforcement.

More recently, it was learned that the company had liquidated its entire Israel research location, firing all 23 of its staff there. No official reason was given, but it seems probable that the collapse in cryptoasset prices is involved. Bitmain was also squarely on the side of Roger Ver’s Bitcoin Cash ABC in the recent BCH “Fork Wars,” as CrytpoGlobe had been calling them.

The Fork Wars was a rather grotesque spectacle, and not well looked upon by outsiders to the cryptoasset industry – and can’t have escaped the HKEX’s and SFC’s gazes.